Payroll Configuration

Payroll Cycle & Attendance-based Rules

Monthly Working Days Setting

Select how the system should calculate employee salaries:

- Based on Total Days in the Month: Salary is calculated using

the total calendar days in the month (e.g., 30 or 31 days).

- Based on Working Days Only: Salary is calculated using the

total actual working days in the month, excluding weekends and holidays.

Note: Choose the option that best matches your company's payroll

policy.

Example: Based on Total Days in the Month

Salary Calculation Based On Hourly/monthly

Select how employee salaries should be calculated:

- Hourly: Choose this option if salaries are based on the total

number of hours worked by the employee.

- Monthly: Choose this option if employees receive a fixed

monthly salary regardless of hours worked.

Example: If your company calculates pay

based on hours worked, select Hourly.

Example: Monthly

Monthly Working Hours

If your organization calculates salaries based on a fixed number of working hours

per month, enter that number here. For example, if the standard

monthly working hours are 176, enter 176 in this field.

Example: 200

Salary Start Date

Enter the date from which salary processing should start. This helps exclude

salary calculations for months prior to the specified date during initial setup. Format: YYYY-MM-DD

Example: 2024-01-01

Leave & Encashment

Paid Leave Given Criteria

Select "Yes" if your organization allows employees to receive payment

for unused paid leaves. When enabled, the value of unused paid leaves will be paid out at the end of the

year or as per company policy. Example: If employees are entitled to

12 paid leaves annually and unused leaves are compensated at year-end, enable this option.

Example: Monthly

Paid Leave In-Cash Monthly

Select "Yes" if you want to distribute the value of paid leaves monthly

as part of the employee's salary. Example: If employees are

entitled to 12 paid leaves per year and you wish to encase 1 leave each month, enable this option.

Example: Yes

Security & Verification

Password Protection Policy

Select your password protection policy for salary slips. Choose one of the

following options:

- NAMEBIRTH: Password is created using the first 4 letters of

the employee's name followed by the 2-digit day and 2-digit month of birth.

- Aadhaar Card: The employee's Aadhaar number is used as the

password.

- PAN Card: The employee's PAN number is used as the

password.

Example: Name -KRISHNA, Birthdate -

19th January? Password: KRIS1901

Example: Name + Birth.

Salary Slip company signature option

If set to Yes the salary slip will display

the default signature that has been uploaded in the system configuration Payroll Configuration > Security

& Verification > Salary Slip Company Signature Option. If set to No the salary slip will be generated without the default signature.

Example: Image

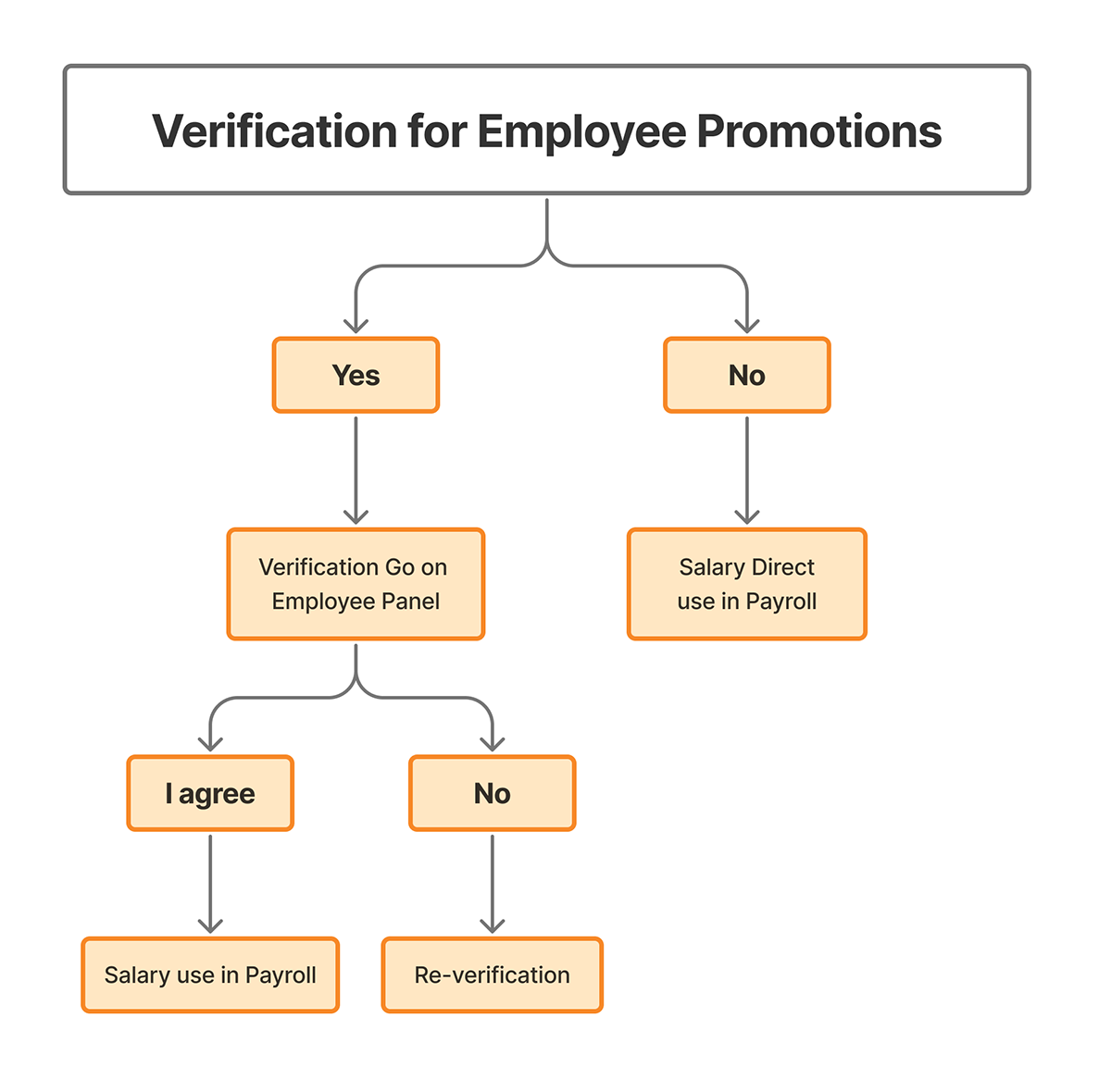

Verification For Employee Promotions

Set this option to "Yes" to require verification whenever an

employee's promotion record is added or edited. This ensures all promotions are reviewed and approved

before being finalized in the system

Example: Yes

Bank & Salary Processing

Select Default Bank For Salary

Select the bank through which employee salaries will be processed. This choice

will be used to manage accounting and transaction records accurately.

Example: ICICI Bank

Minimum Basic Salary Requirement

Enter the minimum basic salary that must be assigned to an employee. This ensures

compliance with company policies and statutory wage requirements, maintaining fair and legal compensation

standards.

Example: 0

TDS Cut Percentage

Enter the TDS (Tax Deducted at Source) percentage to be applied. For example,

entering "10" will automatically calculate and deduct 10% from each employee's salary as TDS.

Example: 0

Statutory Components ( compliance)

Toggle statutory deductions to comply with Indian law.

Allow Professional Tax

Do you want the system to automatically deduct Professional Tax from employee

salaries? Select "Yes" to enable this deduction in compliance with applicable state laws and local

tax regulations.

Example: No

Allow ESI

Do you want the system to deduct ESI (Employees' State Insurance)

contributions from employee salaries Select "Yes" to enable automatic ESI deductions as per

government guidelines, ensuring compliance with labor laws.

Example: No

Allow Education Cess

Do you want the system to deduct Education Cess from employee salaries? Select

"Yes" to enable automatic deductions in accordance with applicable tax regulations, ensuring

compliance with statutory requirements.

Example: No

Employee Money Claim Deduct From Salary

Do you want the system to deduct money claims (such as reimbursements) directly

from employee salaries? Select "Yes" to enable automatic deductions, ensuring amounts are

accurately deducted according to company policy.

Example: No

Allow EPF

Do you want the system to deduct the Provident Fund (PF) from employee salaries?

Select "Yes" to enable automatic PF deductions, ensuring compliance with labor laws and retirement

benefit regulations.

Example: No

Is PF On Day Wages?

Enable this option to calculate Provident Fund (PF) based on daily wages. The

calculation will use the formula:

(Wages ÷ Working Days) ×

Present Days × EPF Percentage. To know more

click

here.Example: No

Calculate EPF/ESI On Overtime & Paid Leave

When "Overtime" is enabled, ensure the overtime component is included in

the Earning Salary configuration. This allows accurate calculation of EPF (Employees' Provident Fund)

and ESI (Employees' State Insurance), ensuring that both overtime and paid leave are considered for

deductions according to applicable regulations. To know more

click

here.Example: No