Finance Management

The financial health of any company holds paramount significance and its efficient management is the key to unlocking accelerated growth and expansion.

Effectively manage your budget to allocate resources efficiently and achieve financial goals.

Compare current expenses with those of previous years to make informed decisions and identify cost-saving opportunities.

Streamline your invoicing process and send payment reminders to ensure timely revenue collection.

Keep track of sent proposals to monitor client interactions and potential business opportunities.

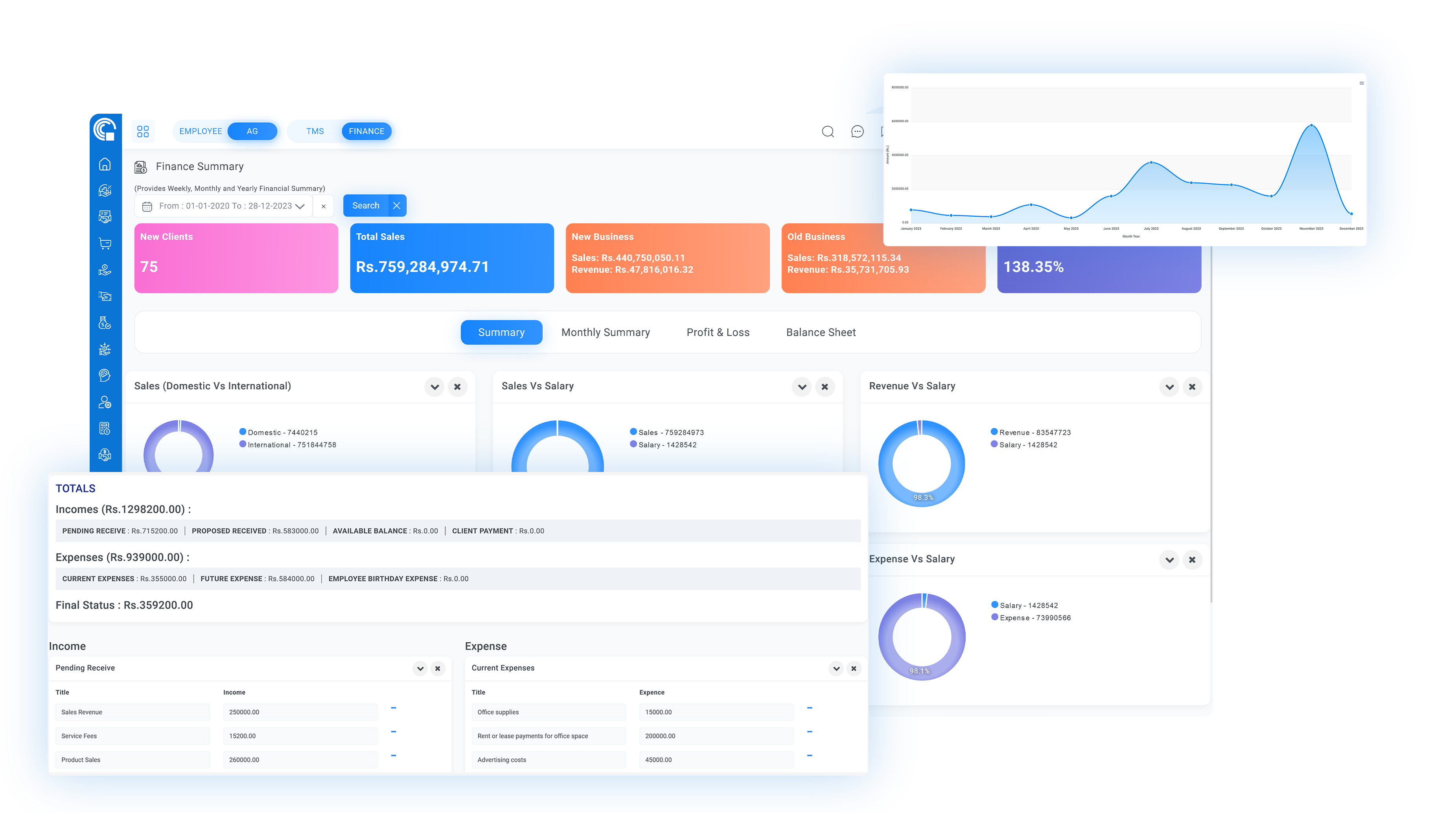

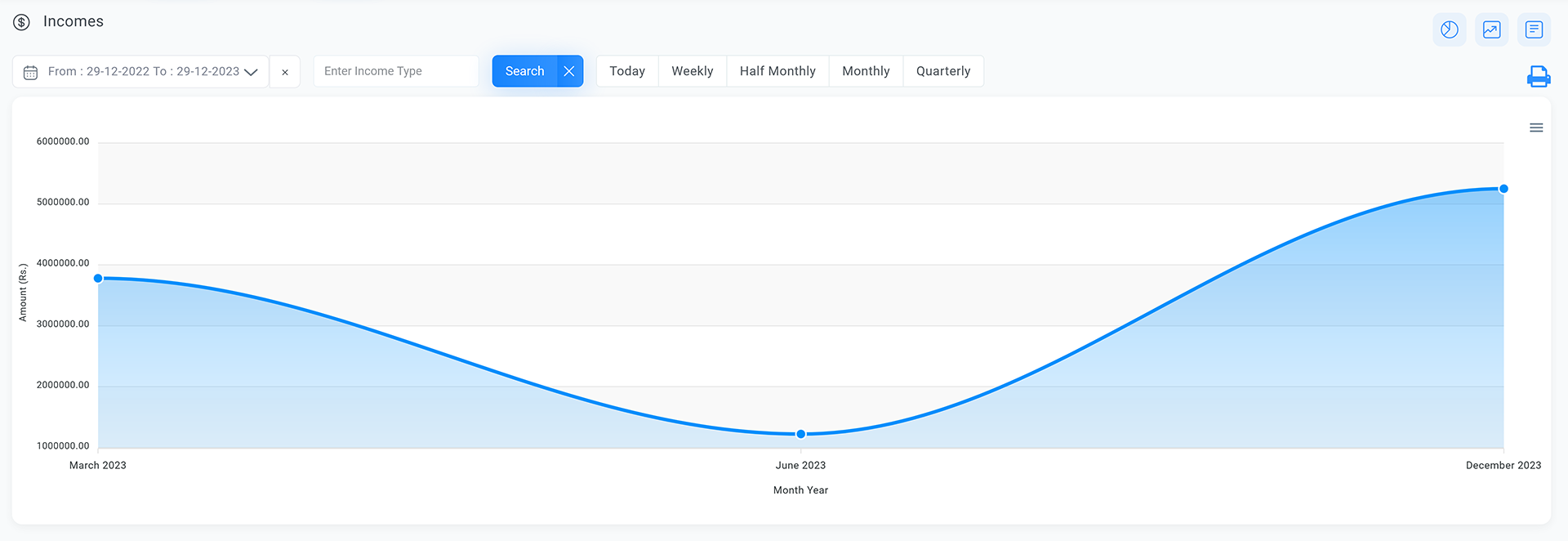

Generate comprehensive financial reports to gain insights into your company's financial health and make informed strategic decisions.

Utilize financial data mapping to manage monthly cash flow effectively, ensuring liquidity and financial stability.

Compare various financial ratios to assess the company's performance and identify areas for improvement.

Share financial information with consultants or advisors to benefit from expert insights and guidance.

Capabilities

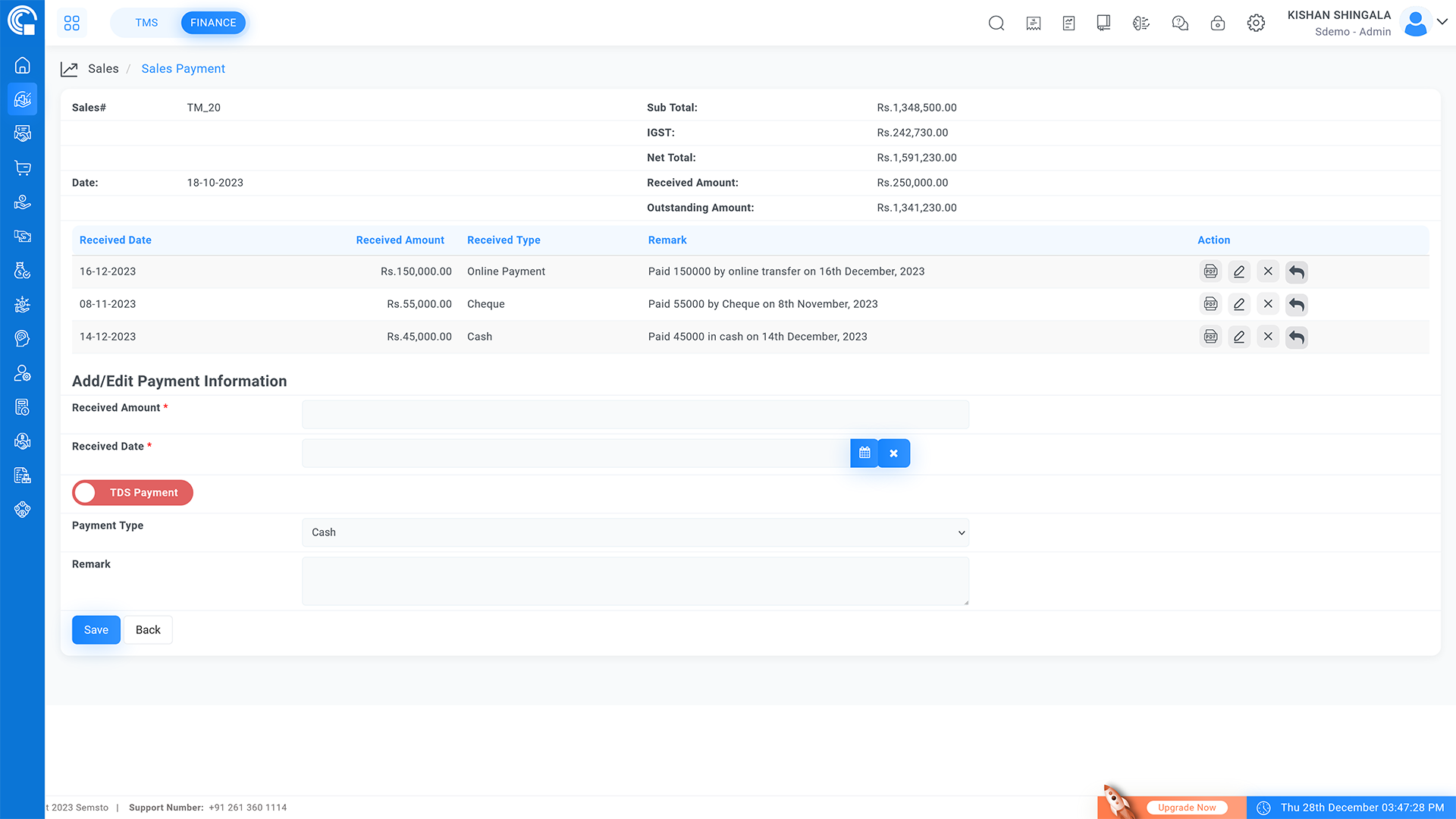

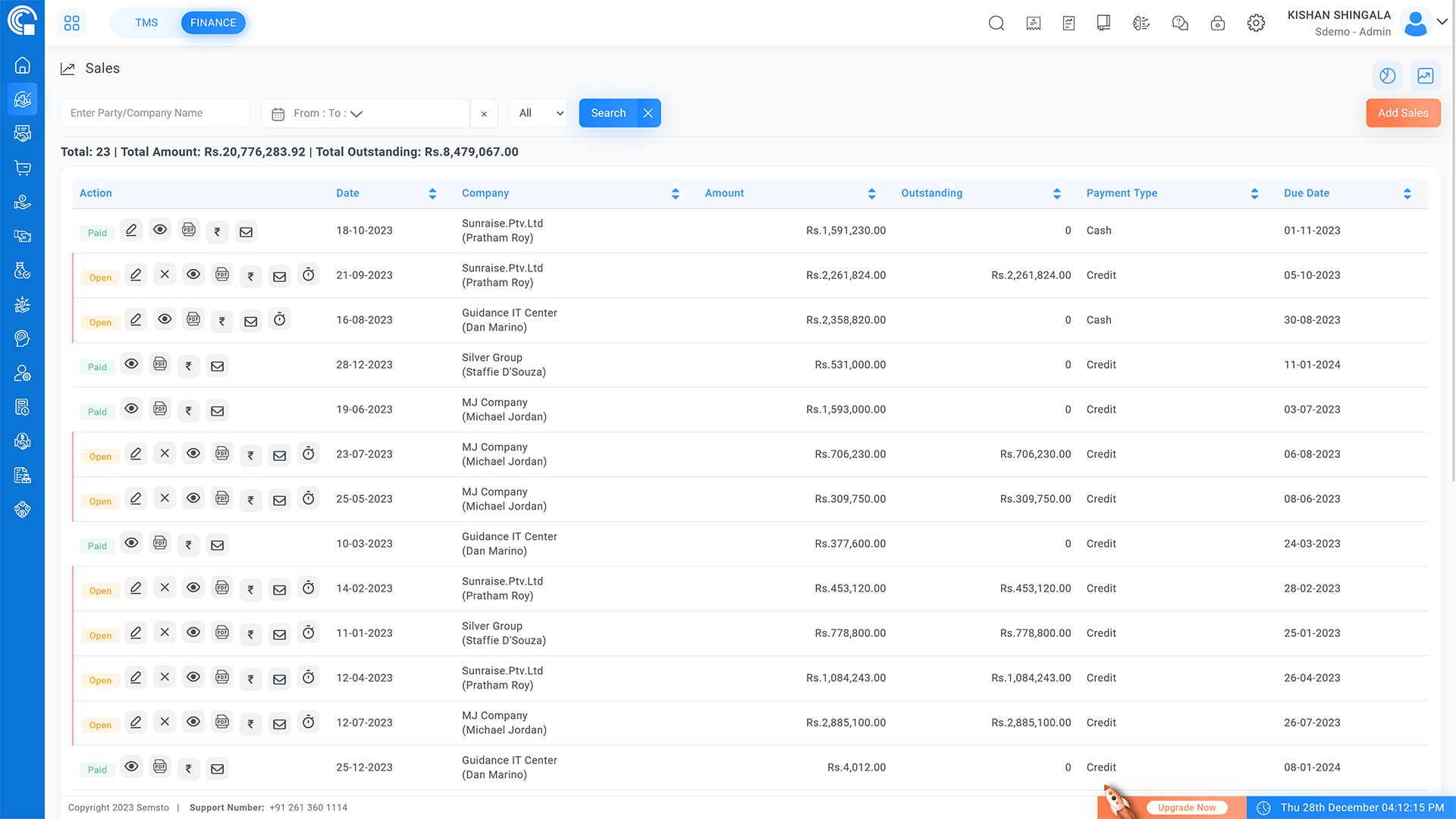

Sales and Payments

Invoice Creation:

Easily generate invoices for your clients with all necessary details.

Recurring Invoices:

Recurring invoices now generate as drafts for easy review and approval.

Payment Tracking:

Keep a record of payments received from clients to ensure accurate accounting.

Payment Reminders:

Send payment reminders to clients to facilitate timely payments.

Instant Communication:

Send invoices and payment confirmations instantly for efficient client interactions.

Project Profit Identification:

If an invoice is linked to a specific project, you can identify the project's profitability, aiding in project management and financial analysis.

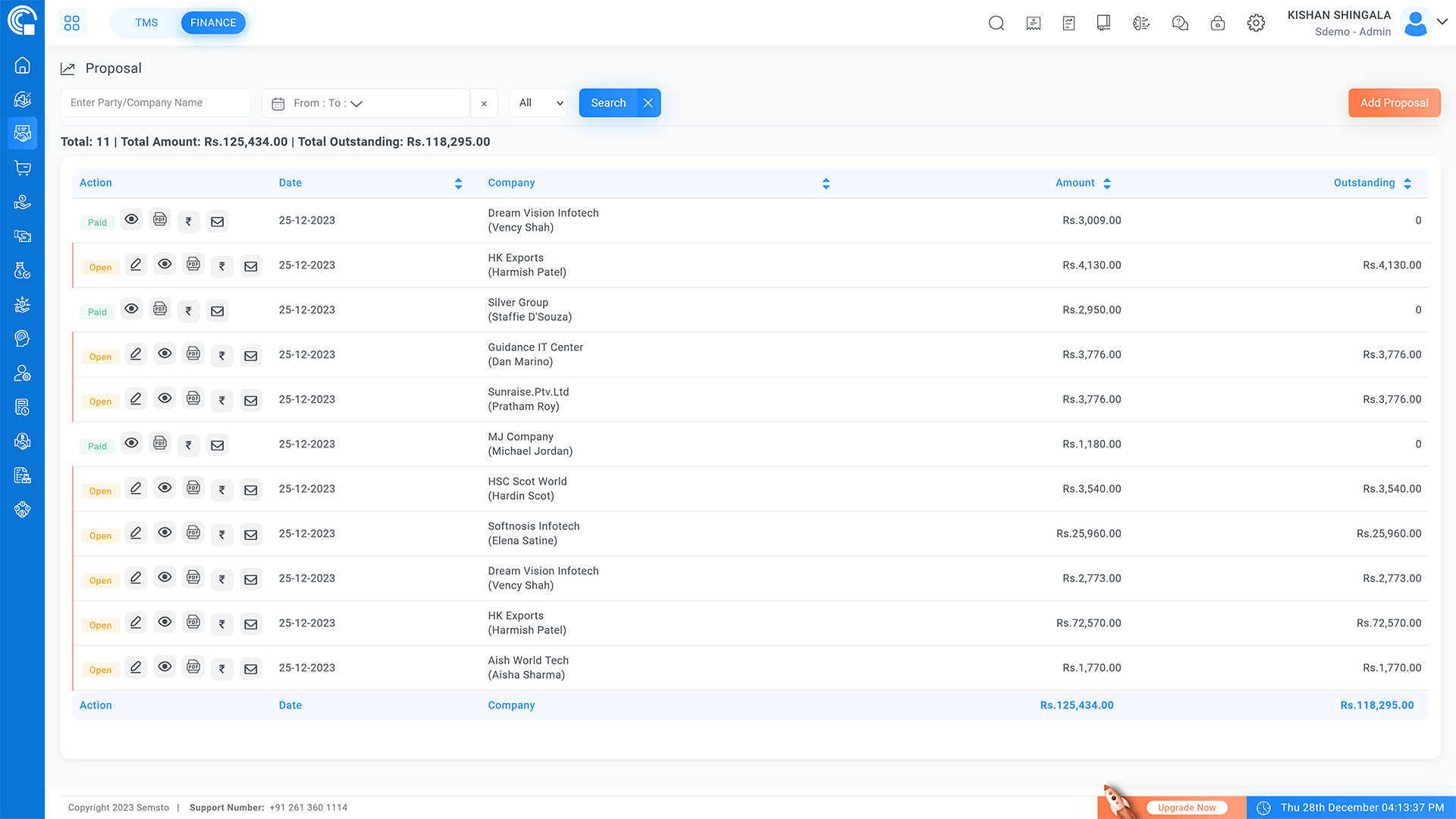

Proposal

Proposal Creation:

Easily create client proposals tailored to their specific needs and preferences.

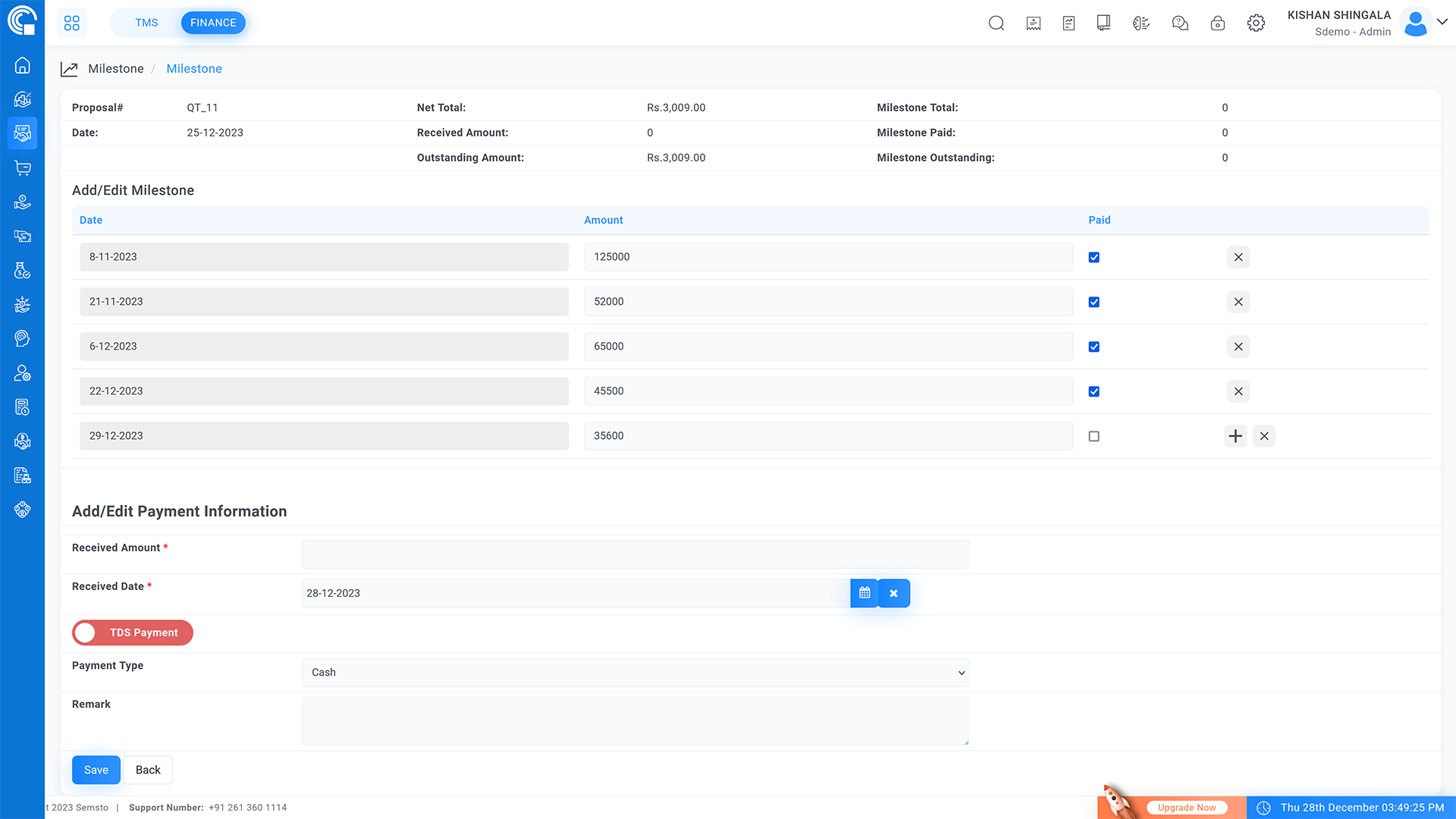

Milestone Tracking:

Set and keep track of project milestones to ensure timely progress and completion.

Financial Monitoring:

Monitor the financial aspects of the project by tracking the amount of money received for each milestone achieved.

Project Transparency:

Maintain transparency in project management and financial control, enhancing client satisfaction and overall project efficiency.

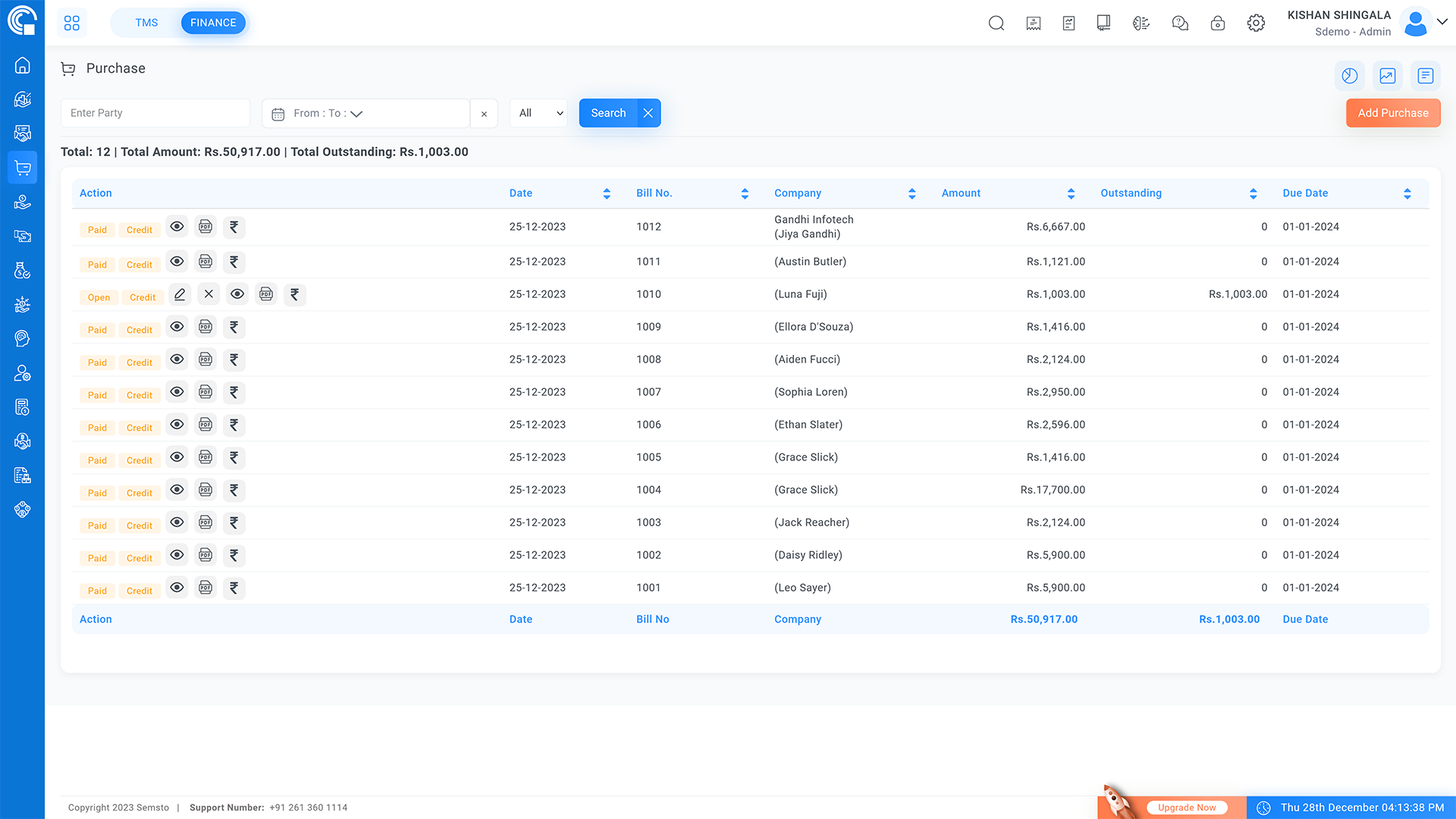

Purchase

Purchase Management:

Effortlessly handle all your purchases, maintaining a clear record of each transaction.

Payment Tracking:

Keep track of payments made for each purchase, ensuring accurate financial records.

Recurring Purchase:

Recurring purchases can be scheduled automatically for smooth tracking and control.

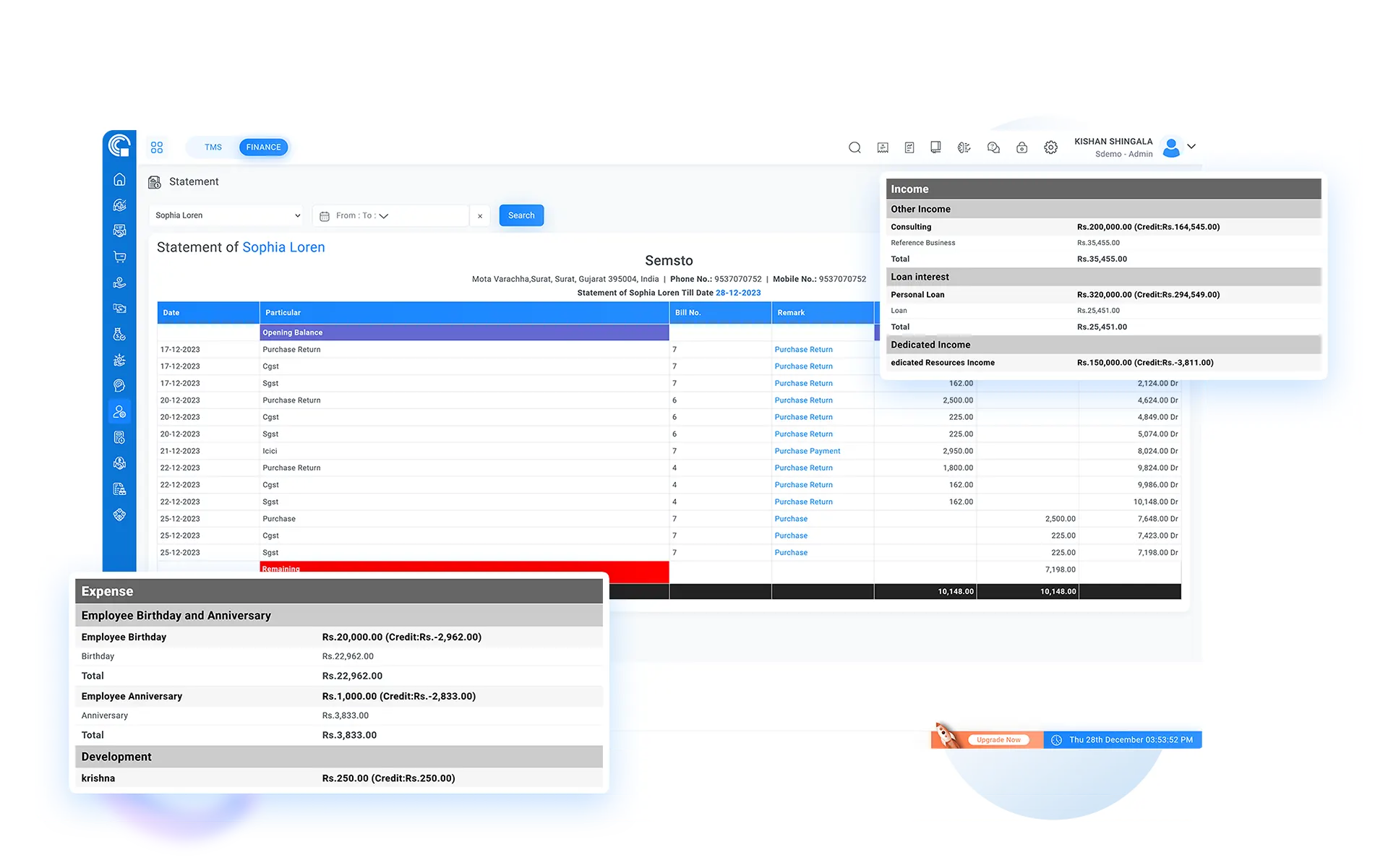

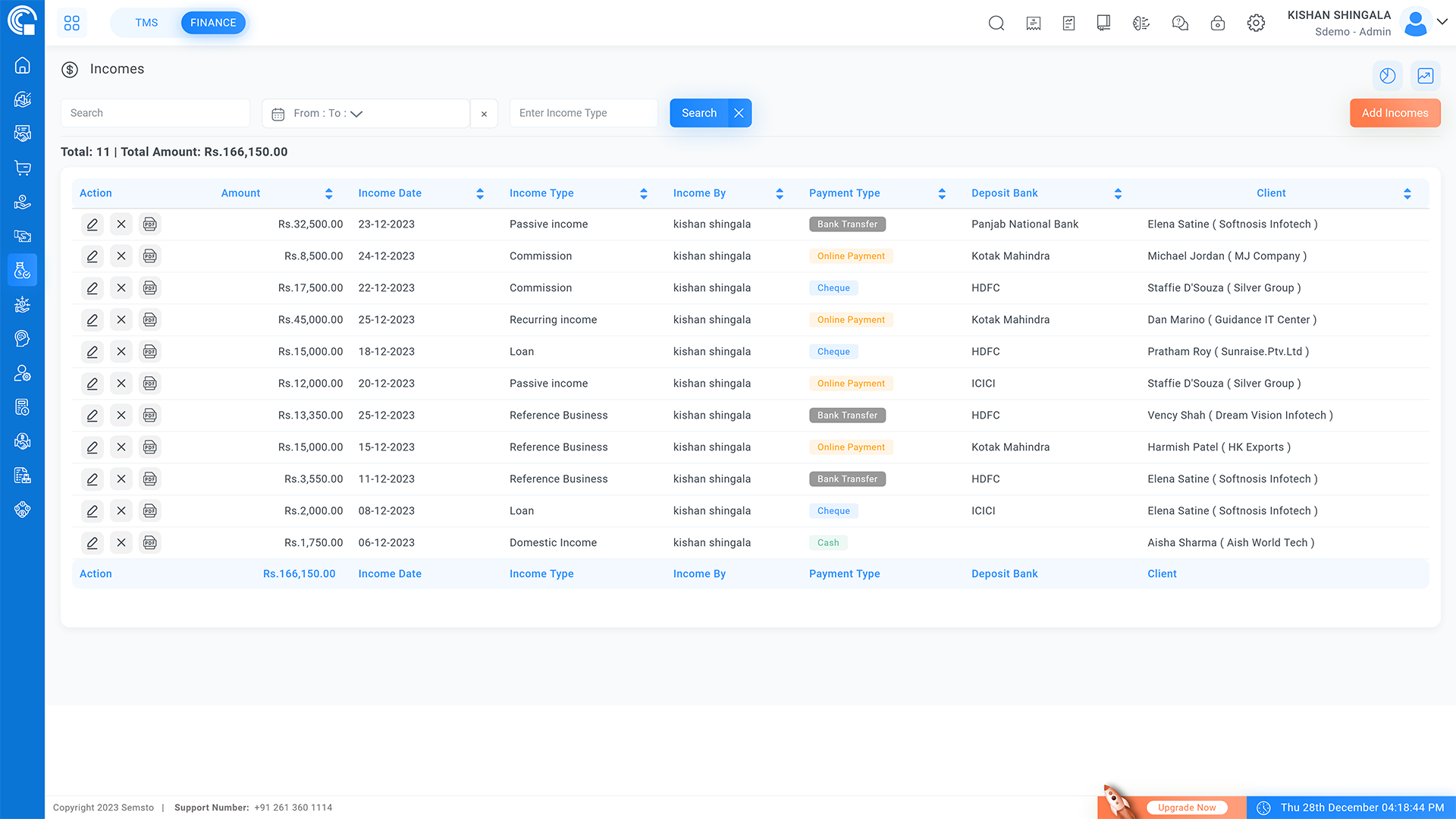

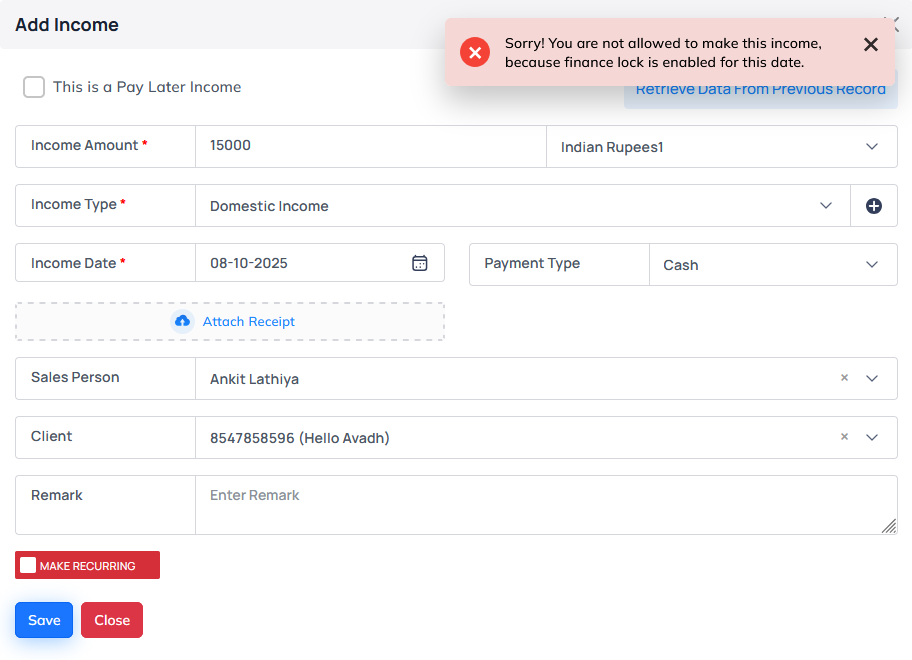

Expense/Income

Income and Expense Tracking:

Efficiently track all sources of income and expenses associated with your business operations.

Accurate Accounting:

Maintain accurate financial records, enabling precise accounting and financial management.

Cost Analysis:

Gain insights into the cost of running your business, allowing for informed financial decisions and optimizations.

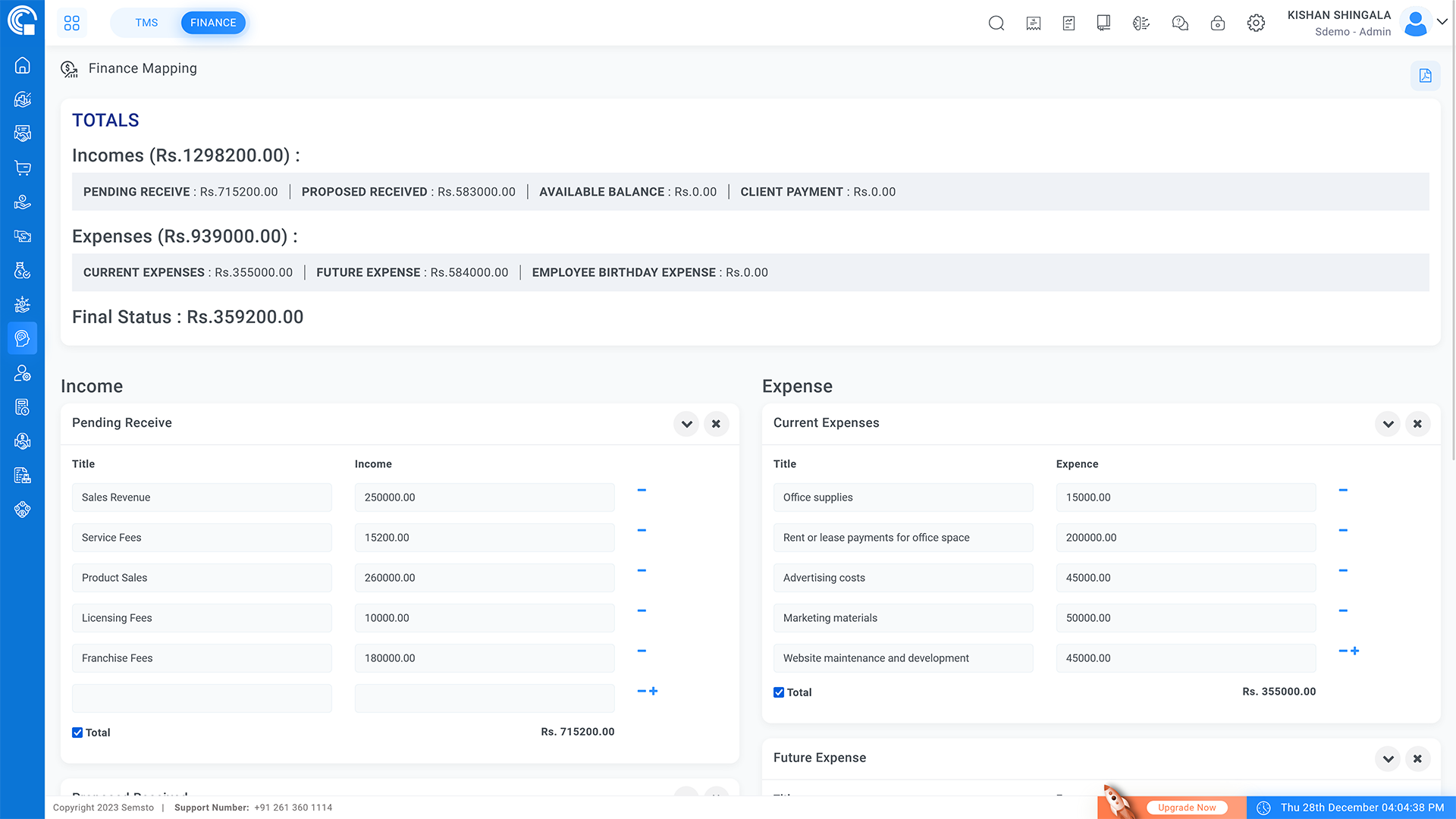

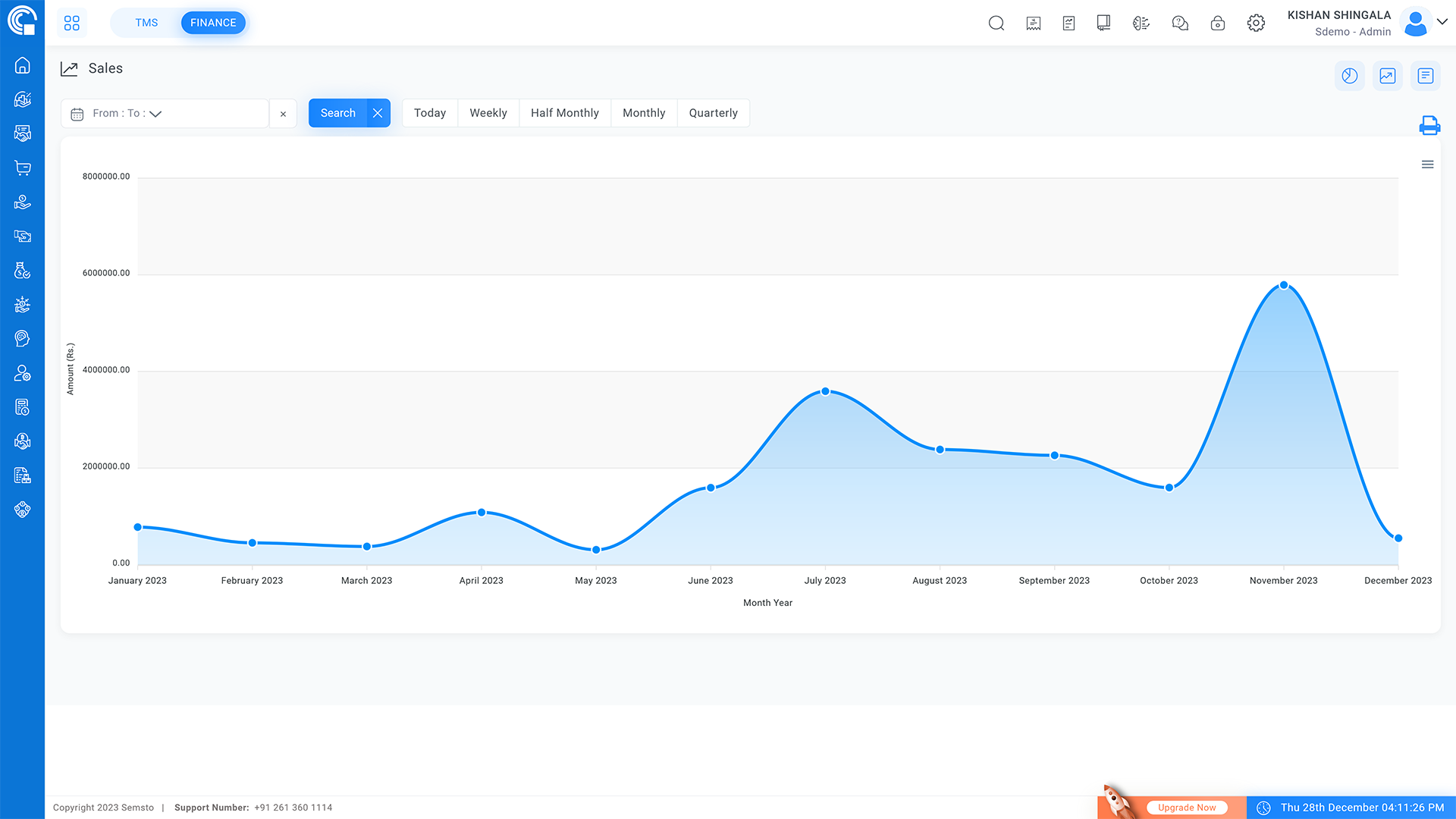

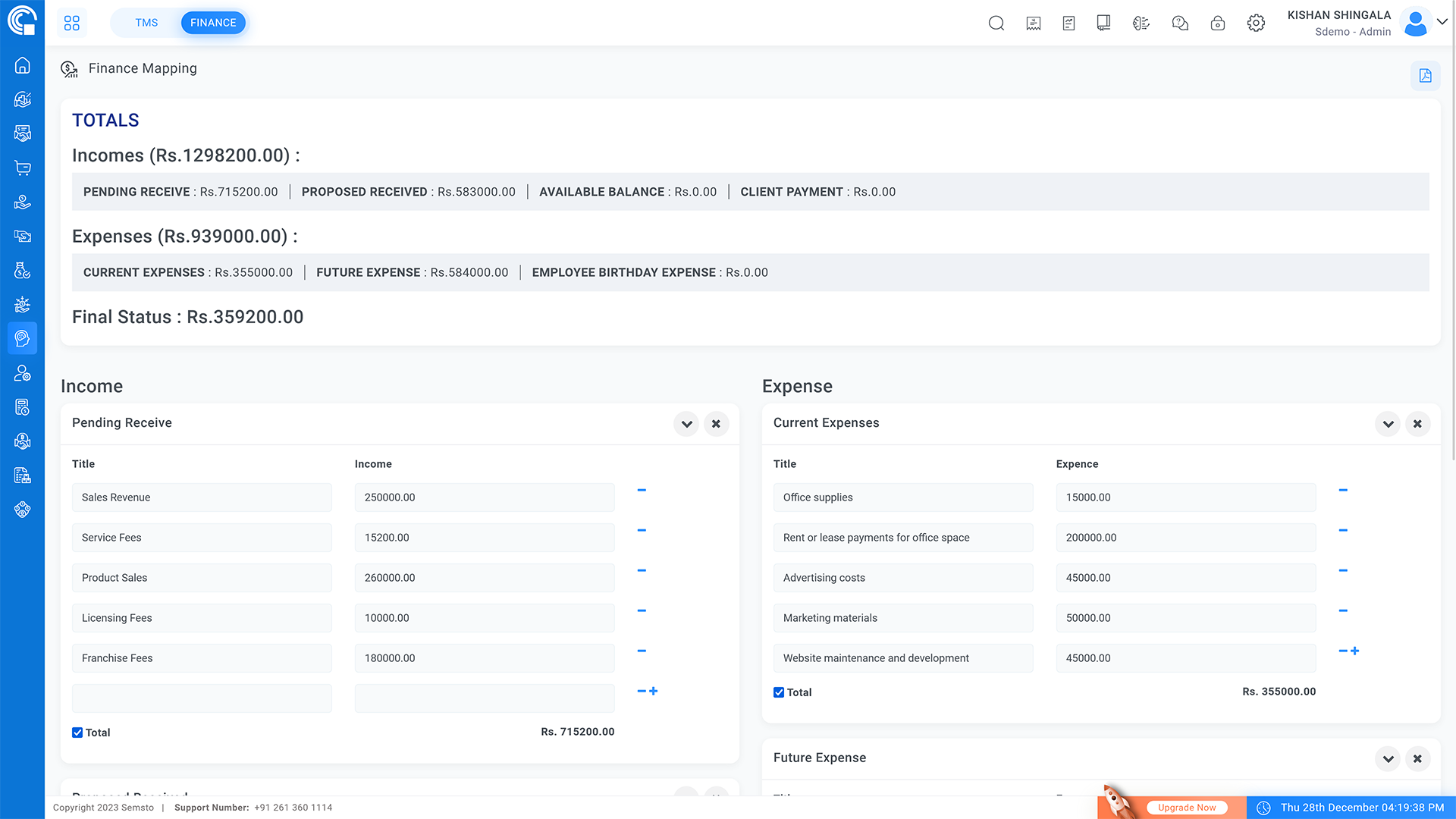

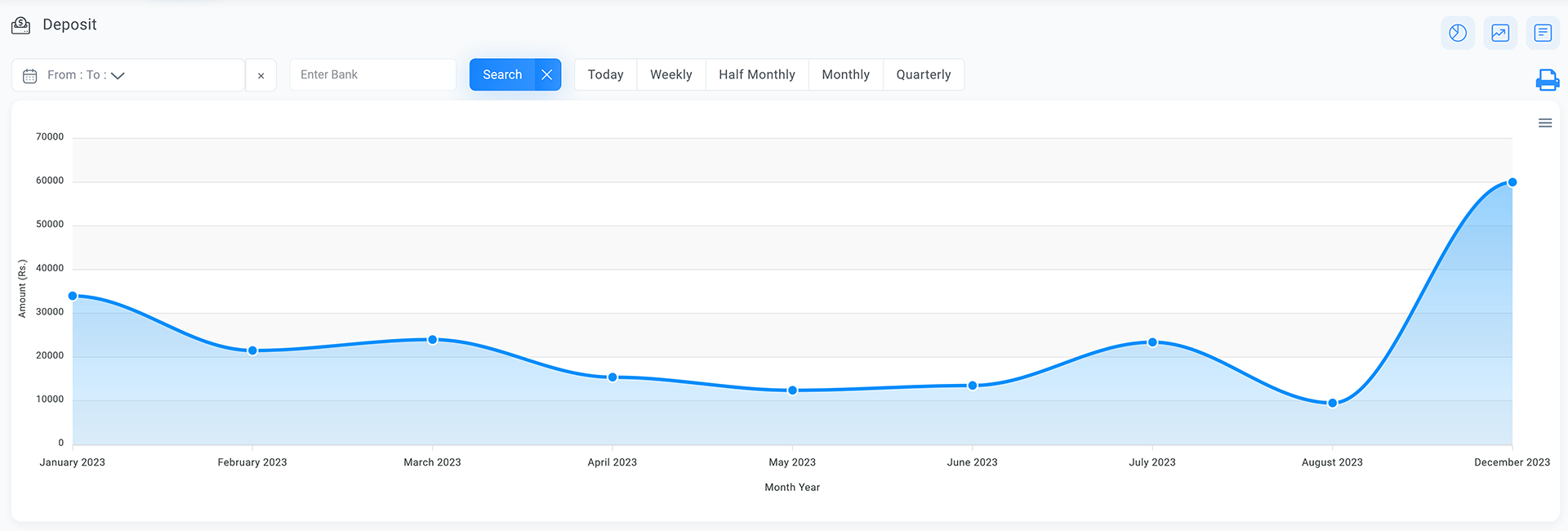

Finance Mapping

Short-Term Financial Mapping:

Map out short-term financial information, including expected income, proposed payments received, expenses and planned expenses.

Cash Flow Analysis:

Utilize this data to assess your short-term cash flow, gaining insights into your financial liquidity and short-term financial health.

Informed Decision-Making:

Make well-informed decisions based on your short-term cash flow analysis, ensuring financial stability and agility in your business operations.

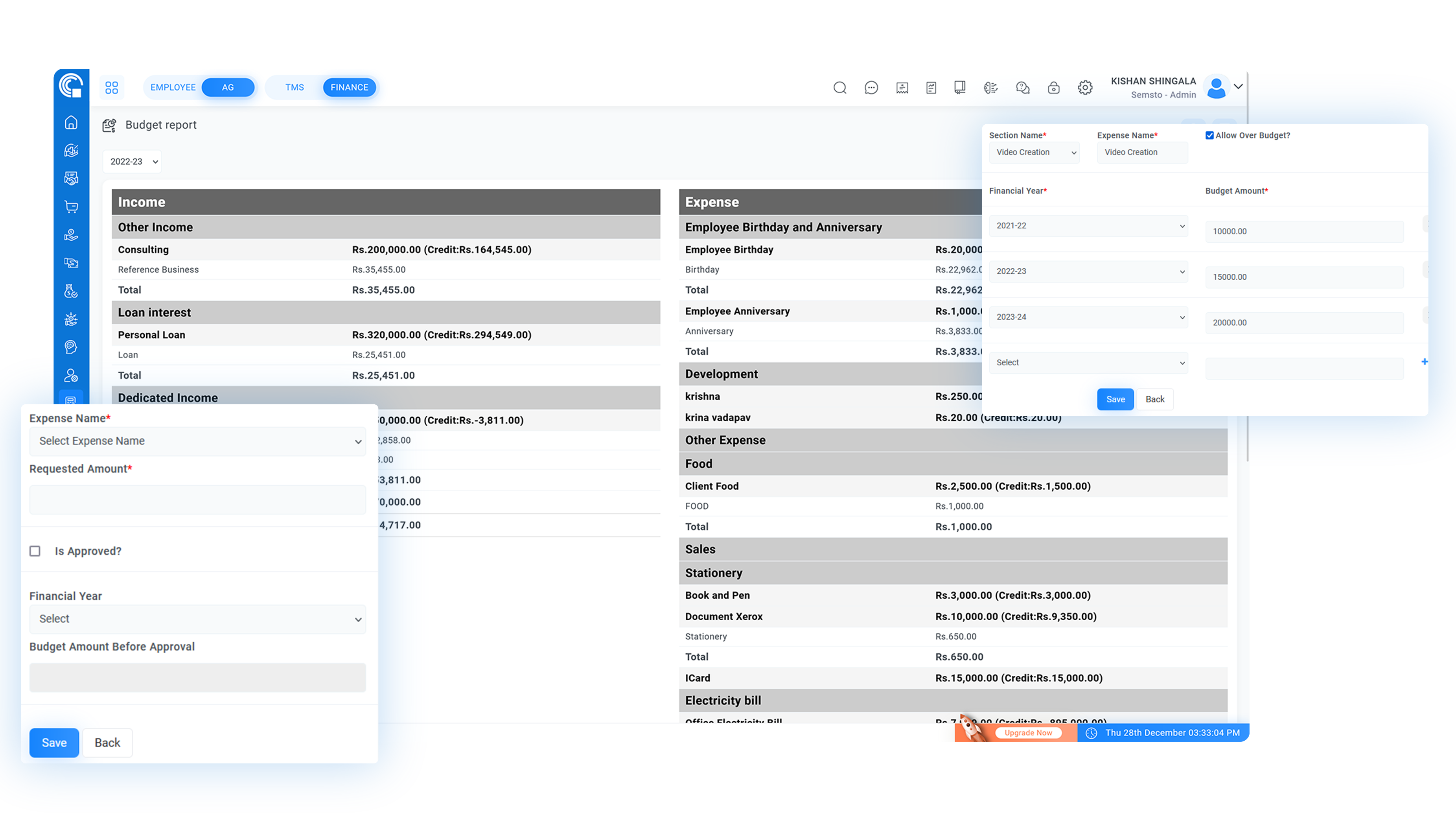

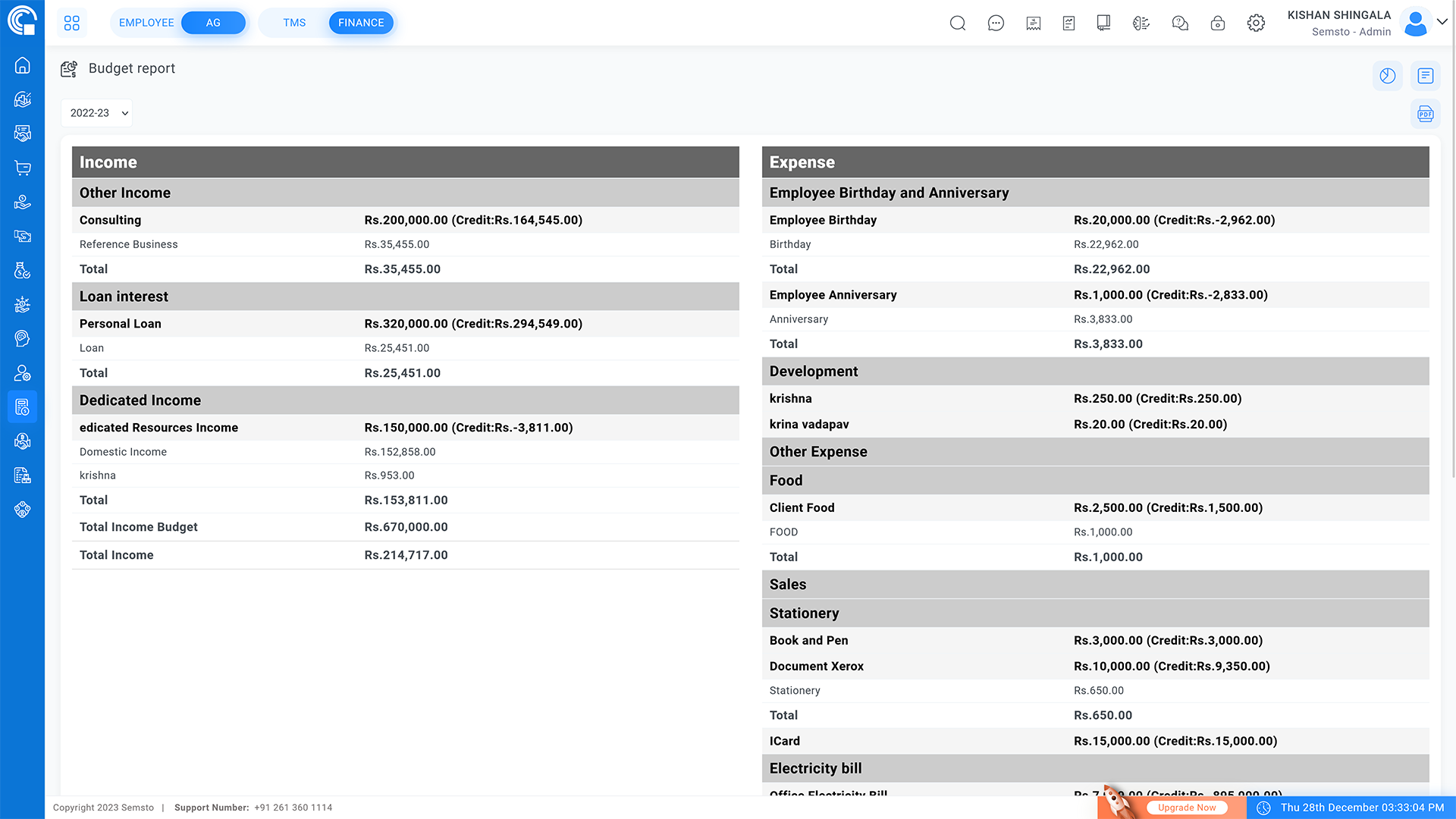

Budgeting

Group Creation:

Create groups within your financial management system to categorize expenses or projects.

Budget Definition:

Define budgets for each group, setting spending limits or allocations.

Spending Mapping:

Map expenses to specific groups, ensuring that spending is accurately categorized.

Monitoring Usage:

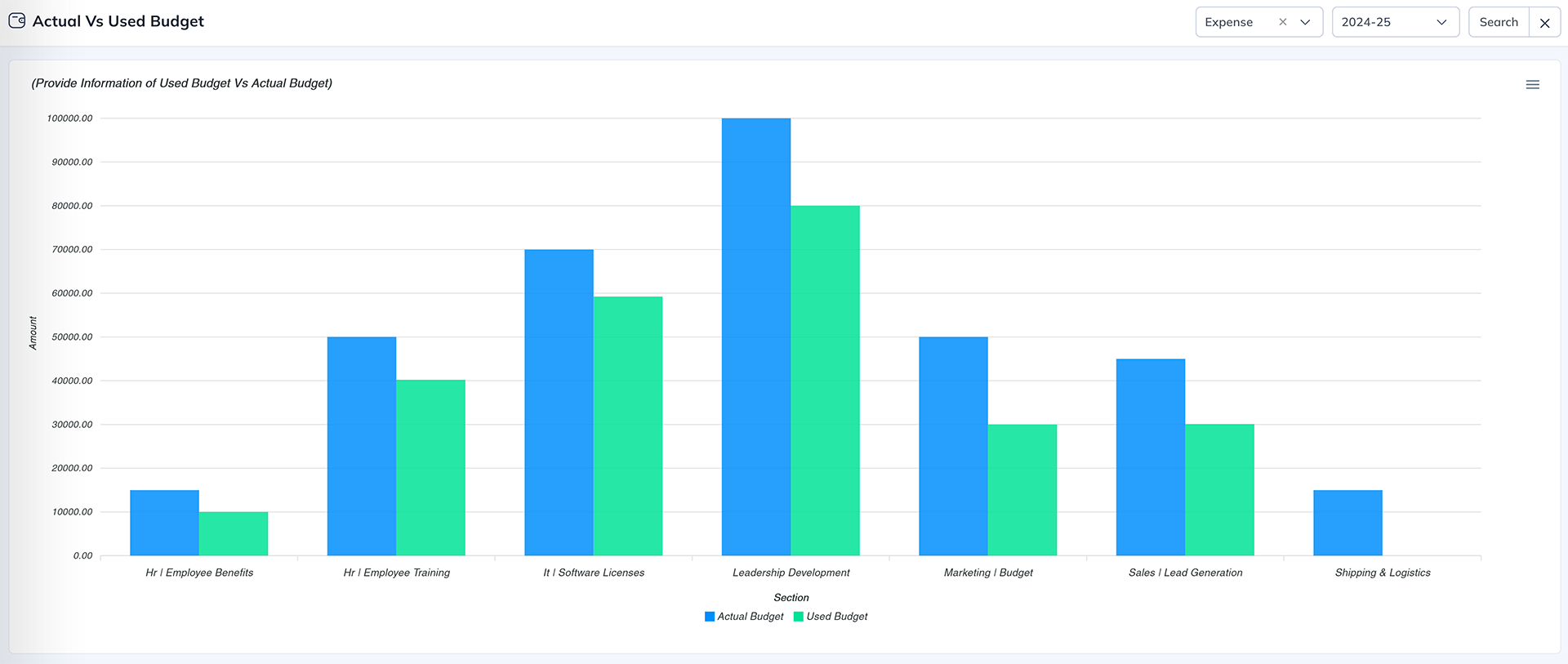

Monitor the utilization of budgets within each group to track spending against allocated amounts.

Budget Comparison:

Compare the current year's budget to those of previous years, enabling you to establish informed financial goals for the current year. This feature provides valuable insights for financial planning and goal setting.

Bank Transactions

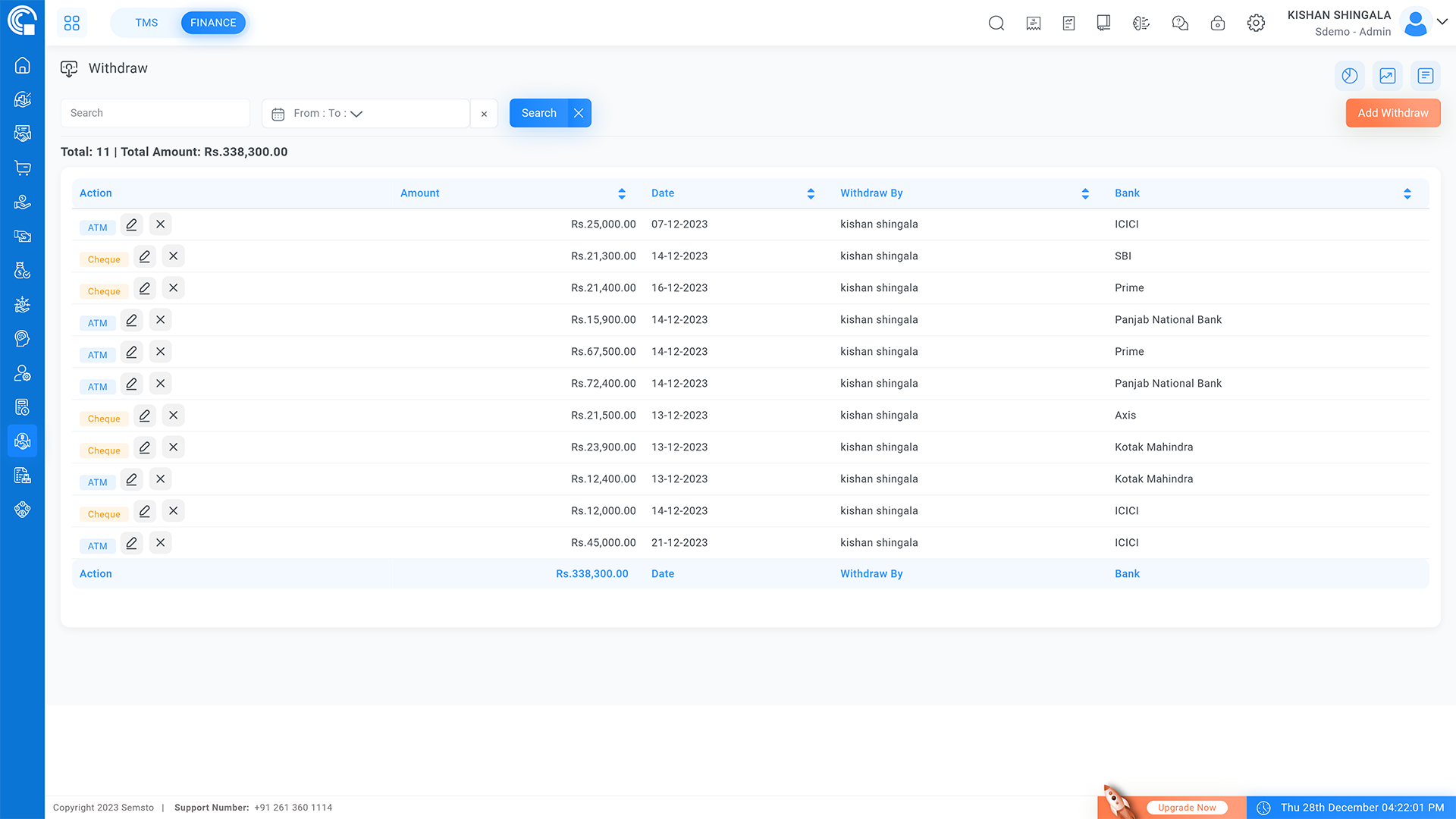

Bank Transaction Management:

Efficiently manage all your bank transactions, including deposits, withdrawals and inter-account transfers.

Account Operations:

Perform operations such as depositing funds into your account, withdrawing money and transferring funds between different accounts.

Financial Transaction

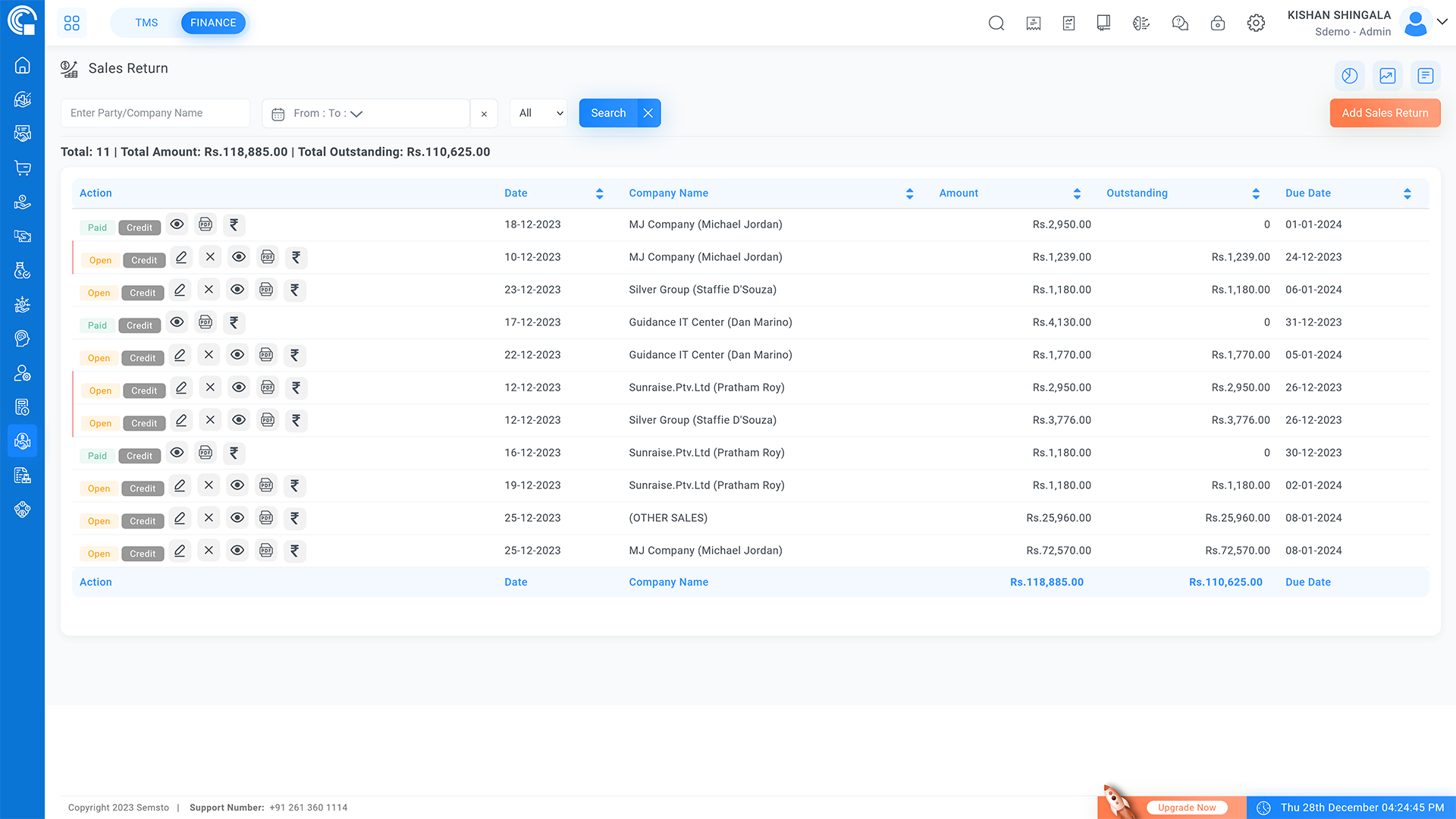

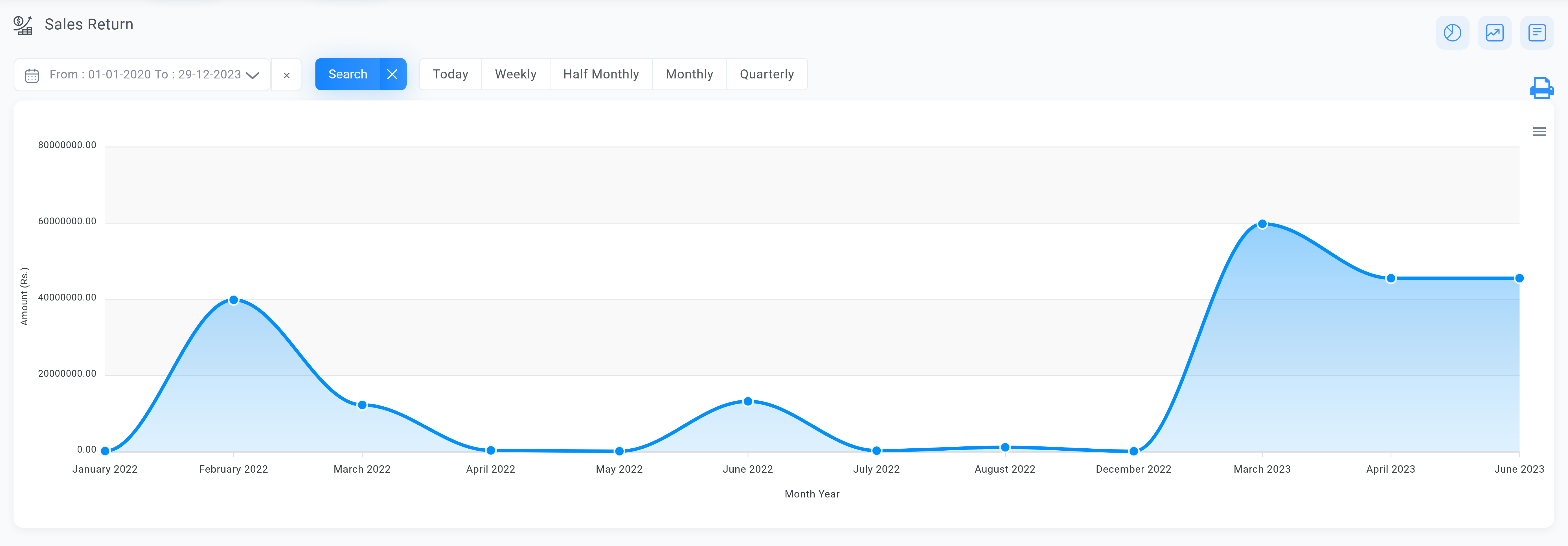

Returns Management:

Efficiently manage returns on sales and purchases, allowing for accurate tracking and handling of returned goods.

Debit Notes:

Generate and handle debit notes for transactions, facilitating adjustments and corrections as needed.

Credit Notes:

Create and manage credit notes to document refunds or credits issued to customers or vendors.

JV Entries (Journal Voucher):

Record journal voucher entries for financial transactions, ensuring proper accounting and financial control.

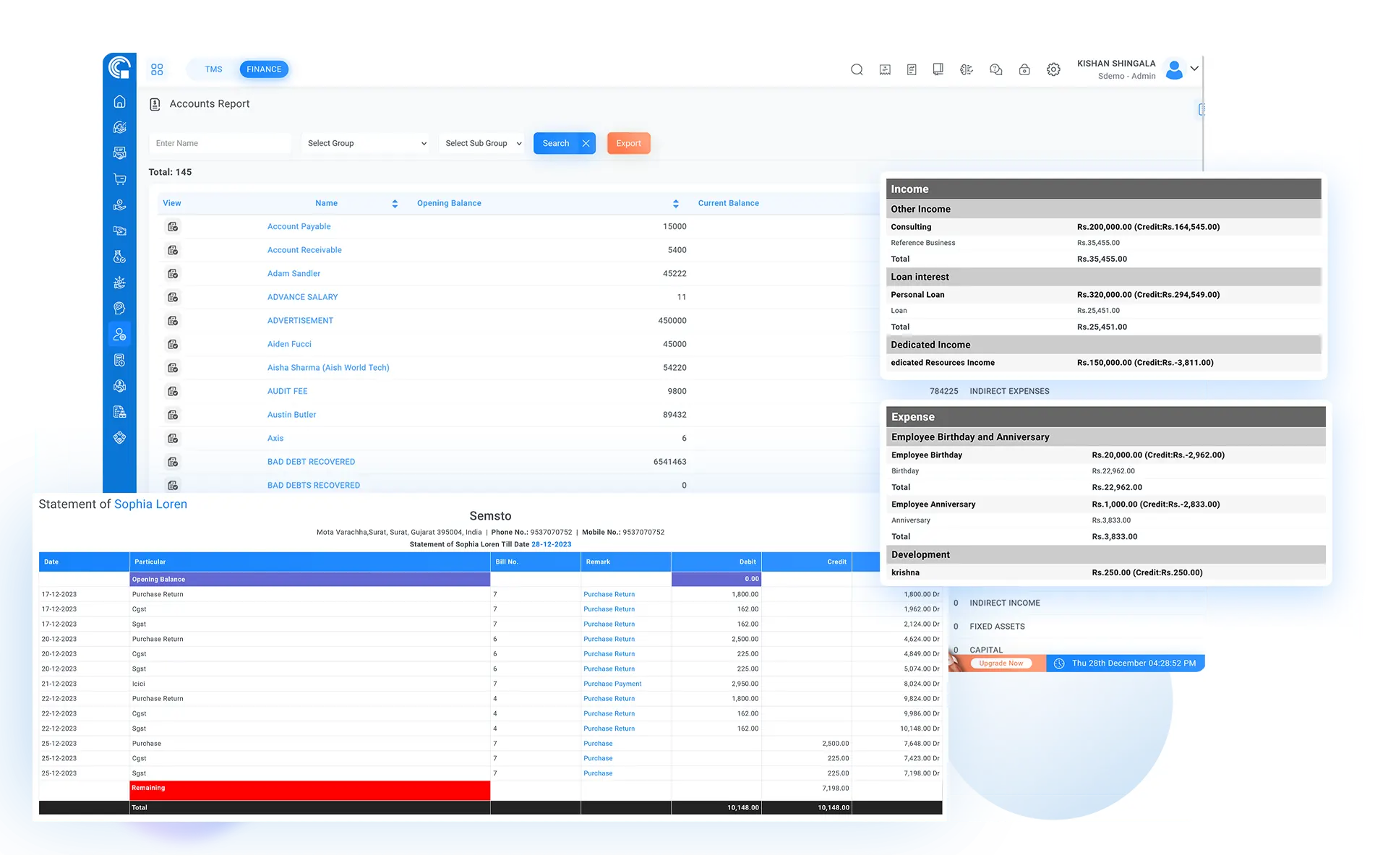

Accounting Report

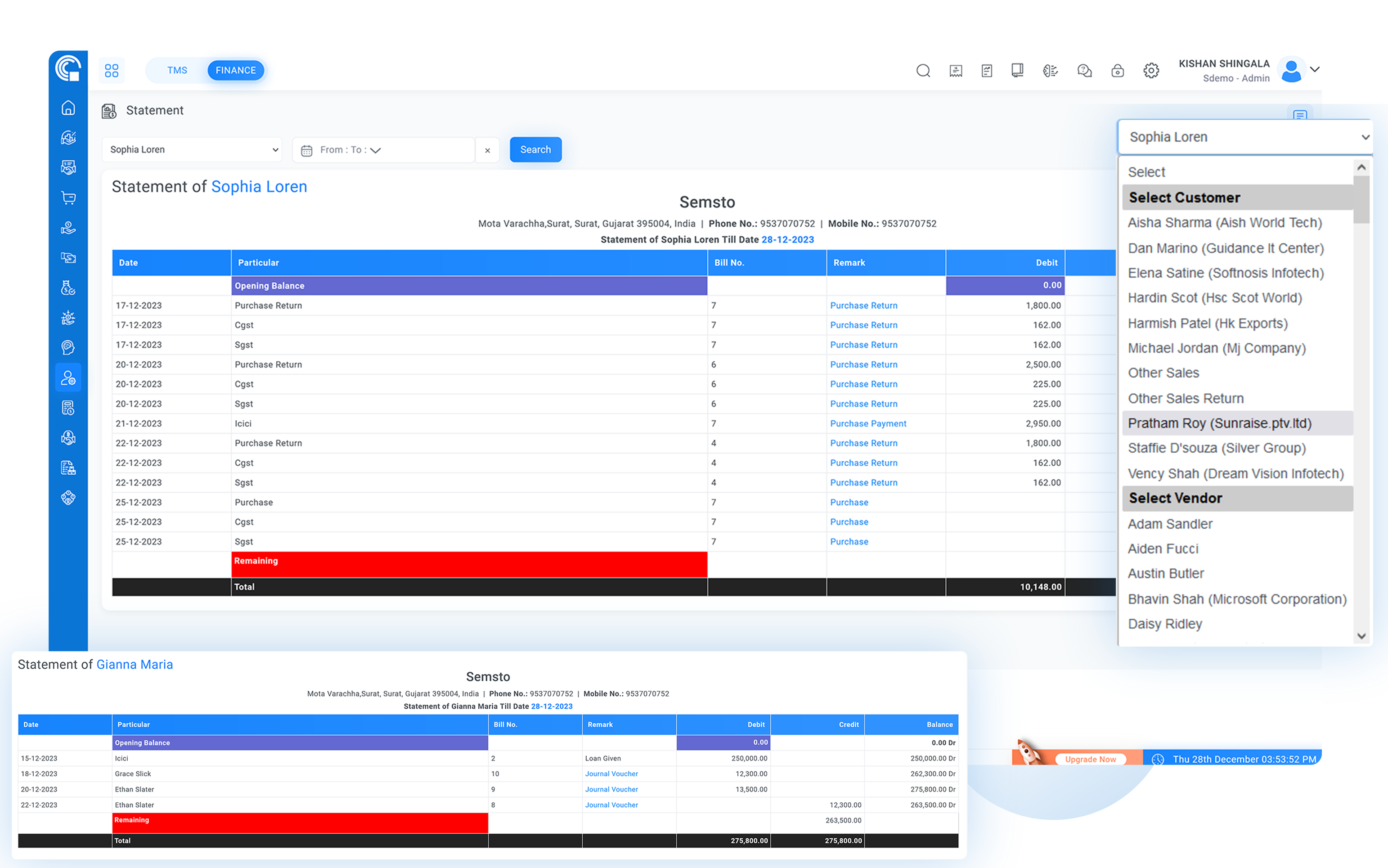

Statement Access:

Easily access statements for parties or banks, providing a clear overview of financial transactions and balances.

Cash Rojmel:

View cash rojmel reports, helping you track cash inflows and outflows for financial analysis.

Trading Account:

Access trading account reports to monitor the financial performance of your business's trading activities.

Profit & Loss Reports:

Generate profit and loss reports to assess your business's financial profitability over a specific period.

Balance Sheet:

Obtain balance sheets to gain insights into the financial health and overall financial position of your business.

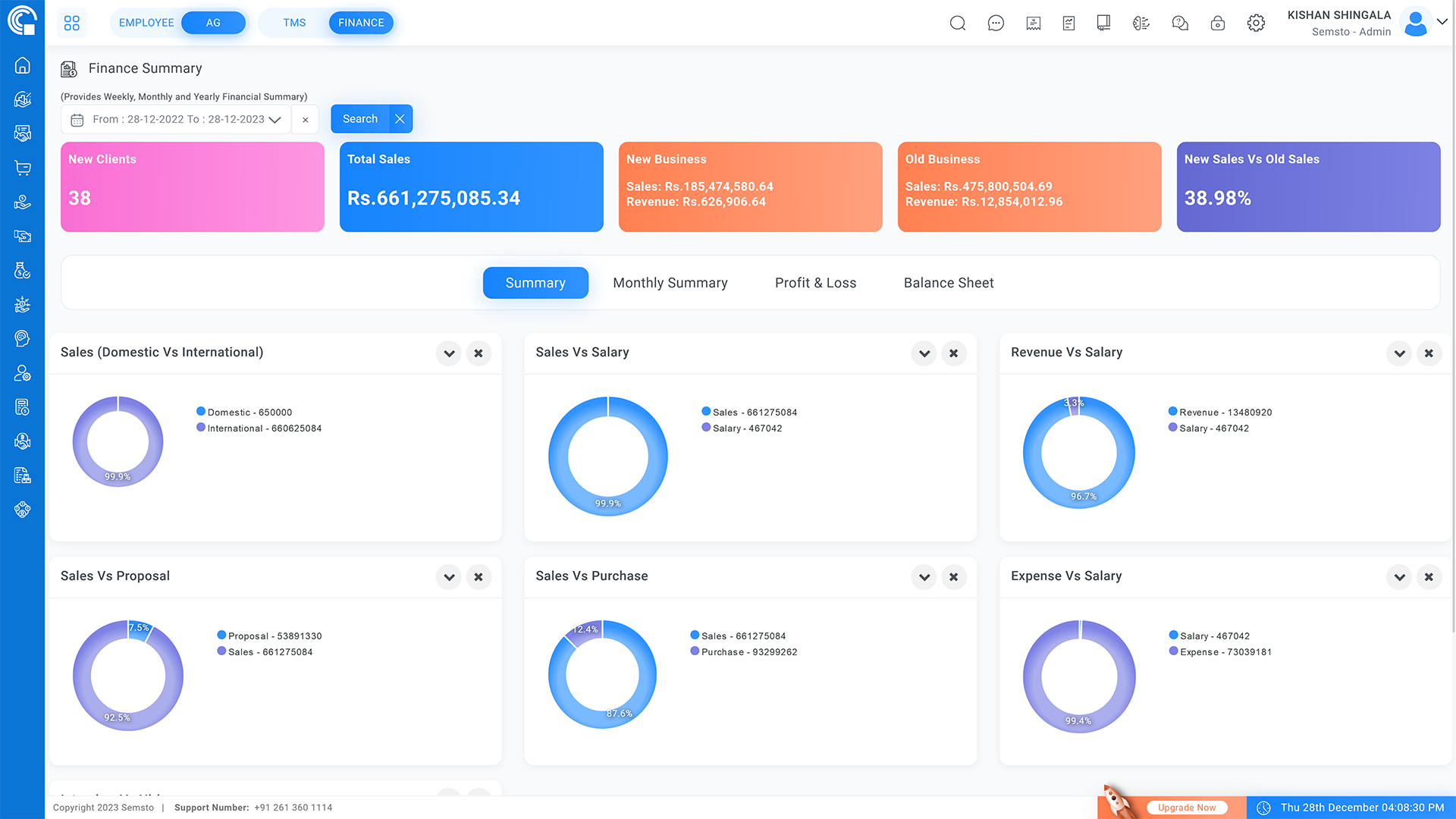

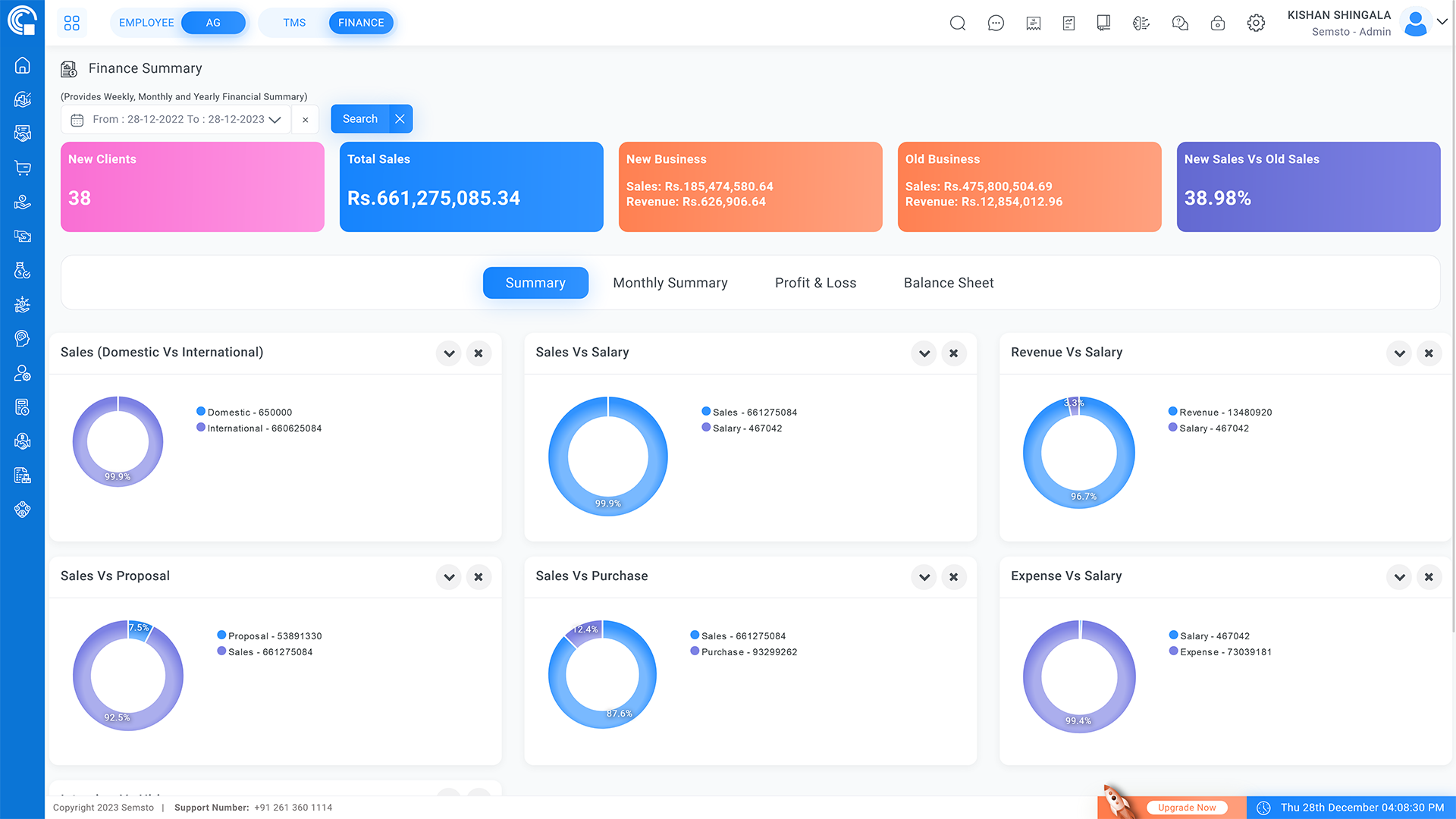

Ratio Analysis

Domestic Vs International Sales:

Compare and analyze the performance of domestic and international sales, identifying trends and opportunities for growth in different markets..

Sales Vs Salary:

Evaluate the relationship between sales revenue and salary expenses to assess the efficiency of labor costs and workforce management.

Revenue Vs Salary:

Analyze the proportion of revenue generated in relation to salary expenses, helping in cost management and resource allocation decisions.

Sales Vs Proposal:

Assess the correlation between sales and the number of proposals submitted, enabling insights into the effectiveness of your sales efforts.

Sales Vs Purchase:

Examine the relationship between sales revenue and purchase expenses to gauge the impact of procurement on profitability.

Expense Vs Salary:

Evaluate the ratio of overall expenses to salary expenses, providing insights into the allocation of resources and cost control measures.

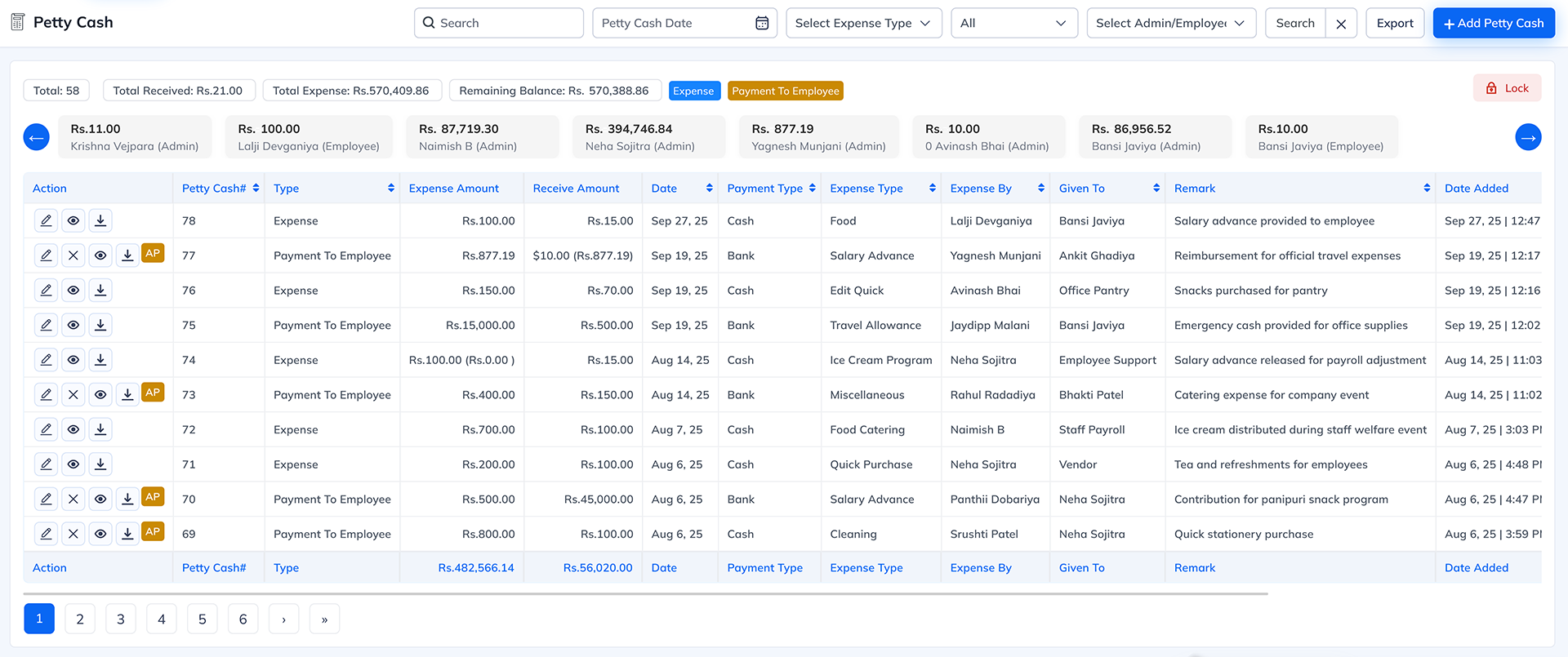

Petty Cash

Cash Advance Tracking:

Record payments given to employees for business expenses and keep a clear history.

Employee Expense Monitoring:

Track how employees spend company funds on behalf of the organization.

Approval Flow:

Ensure all petty cash expenses go through proper approval before finalization.

Transparency & Accountability:

Maintain accurate logs that prevent misuse and make audits simple.

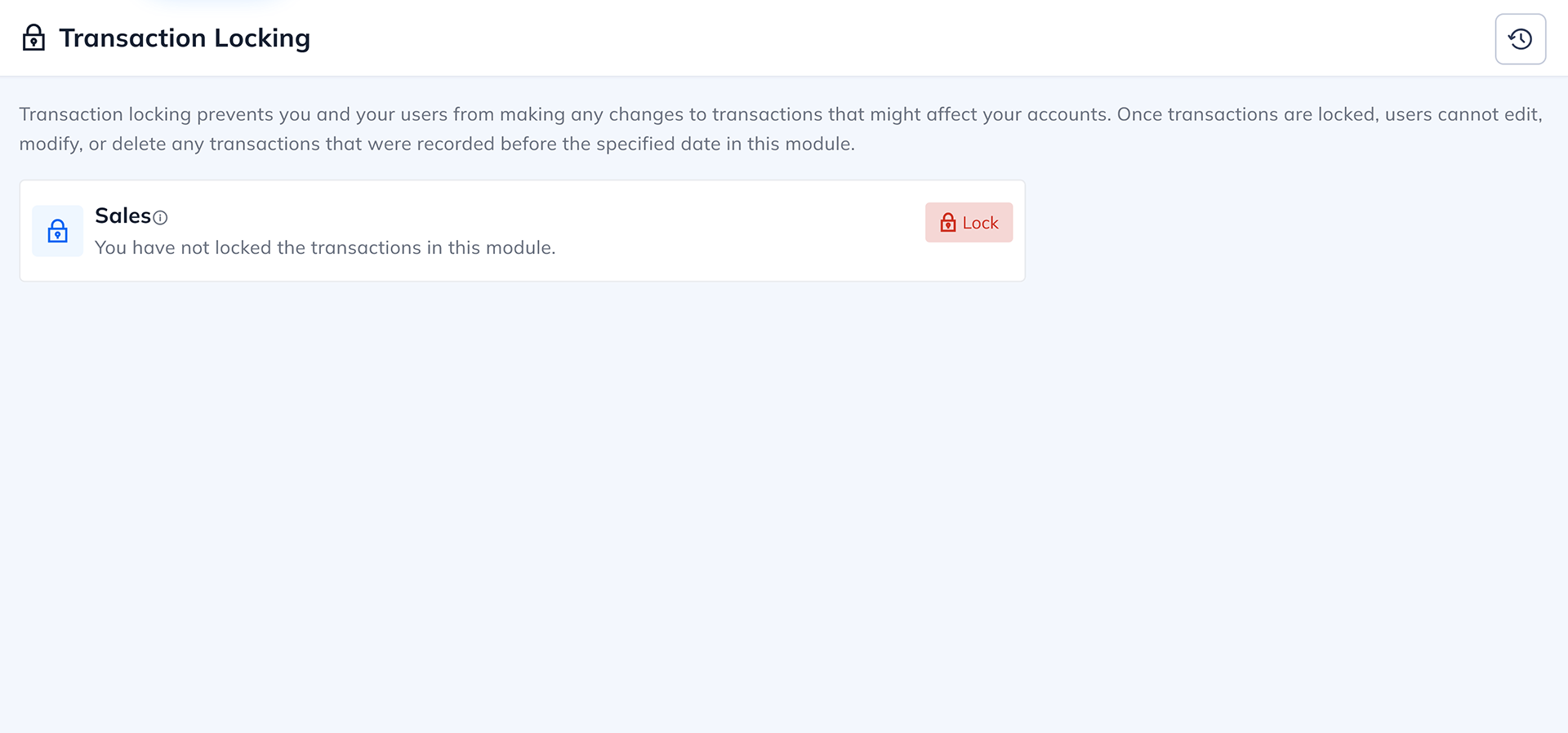

Transaction Locking

Period Locking:

Restrict transactions for a chosen period once the books are closed.

Post-Audit Control:

Secure records after audit completion to preserve accuracy.

Data Integrity:

Prevent unauthorized edits or backdated entries in finalized accounts.

Compliance Ready:

Ensure your financial reports remain consistent and audit-ready at all times.

Pain Points

Managing Budget using Excel

Utilizing Excel for budget management, which can be a manual and time-consuming process.

Manual Procedure for Invoices and Payments

Employing a manual procedure for sending invoices to clients and tracking payments, which can be prone to errors and inefficiencies.

Expenditure Record Keeping

Maintaining a comprehensive record of all expenditures to ensure accurate financial tracking and control.

Financial Data Comparison

Comparing financial data with previous years to assess trends, identify areas for improvement and make informed decisions.

Lack of Financial Information

Facing challenges due to a lack of sufficient financial information to support decision-making processes.

Financial Performance Analysis

Analyzing the financial performance of the company over specific time durations to gain insights and evaluate profitability and efficiency.

Time-Consuming Information Sharing with Consultants

The process of sharing financial information with consultants is time-consuming, potentially impacting efficiency and decision-making.

Petty Cash Clarity

Eliminate untracked employee expenses with clear logs and approvals.

Lock & Protect

Prevent post-audit edits to keep financial data accurate and secure.

Why Finance Management?

Whether you want to start a firm, grow an existing one, add additional equipment, or develop new products, finance is the foundation of every commercial organisation in the modern day. Liquid funds are essential for the organization's day-to-day operations. From the simplest expenditures to the largest business expenditures, finance is essential. Agree?

Today's businesses are exceedingly fragile. Organizations spend a significant amount of money to keep their firm operational and completely functional. But you cannot continue to spend excessively or refrain from spending altogether. Today, it can be claimed that finance is the fuel of business, but its management is also essential for enterprises to achieve success. Only when good management is added to the sphere of finance can its benefits be realised.

While this may not be enough to convince you of the significance of financial management in every organisation, Let's elaborate. However, before discussing the significance of financial management for every organisation, let's define the term.

Financial Management

Finance is unquestionably one of the most essential components of a business. With enormous capital, daily cash flow and continual transactions, it becomes vital to manage and monitor the aforementioned. In reality, handling finances has a significant impact on decision-making. For instance, if the company has more funds, a portion can be used for investment reasons, however if the organisation has fewer funds than the threshold value, it is crucial to stop wasteful expenditure.

Specifically, financial management assists a company in deciding what to spend, where to spend and when to spend. It provides a clearer picture of the organization's financial standing and outlines its financial processing.

Continuing this discussion, we list six reasons why financial management is essential for your company.

Why Financial Management?

Generate Money

To start a business, you would require capital. Obviously, in order to take the initial step and begin a firm, financial investment is essential. In addition, as you go up the project's calendar, acquiring resources, recruiting personnel, marketing and testing, each stage requires financial management.

Organize Operations

Every day, businesses earn enormous amounts of money. This money must be utilised to pay bills, delegate funds, invest in different endeavours and monitor these activities. Managing the flow of money into and out of your firm is essential. In the absence of the aforementioned, it is difficult to allocate funds efficiently and effectively. Remember that erratic cash flow might render a business insolvent.

Manage Cash Flow

As fatal as having insufficient finances is having excessive funds. Cash flow management becomes essential for an organization's day-to-day operations. If you have more money than you need and do not use it appropriately, you are wasting resources. For a business with excess capital, investing in substantial engagements would generate superior returns and help it grow.

Strategize Funding

Obviously, you will need to allot funds and use them to map your recurring expenses. However, it is not advisable to spend money without proper planning. You must track your spending, check their regularity and then decide how and how much to spend. Occasionally, it is necessary to reduce unnecessary costs and expenses. And this is only possible if you efficiently handle your financial obligations. It is recommended that businesses have adequate finances to deal with economic downturns.

Outline Long Term Goals

Organizations strive for growth and expansion of their operations. To achieve this, it is necessary for the organisation to have aspirational long-term objectives that it intends to achieve during the next five to ten years. Financial Management ensures the achievement of an organization's objectives. Consider that you intend to grow your business to three new cities. During actual plan execution, you run out of money. If you had handled your organization's finances and then executed, this would not have occurred. Planning ahead and focusing on the organization's accessible cash enables you to prevent future crisis risks while advancing toward your objective.

To Sustain Economic Downturn

If you examine a company's growth graph, you will never discover one that rises straight or is lack of curves. The growth of the business organisation cycle is a mixture and fusion of highs and lows, which could be caused by a variety of factors. Recession, depression, success and failure all contribute to the demise of a firm. With appropriate funds and effective financial management, it is less difficult for a corporation to progress through the business cycle. Regardless of the severity of the circumstance, they are always prepared to face the problem and accept the repercussions without fear of closure. Financial management strategies that are invulnerable to failure allow a business to thrive despite poor economic conditions.

Conclude:

Given the foregoing, it is evident that management is just as crucial for your organisation as finances. From collecting funds to allocating and spending them, organisational leaders must have a clear view of all financial activities inside the business and plan for the most efficient use of existing resources.