Asset Management

Cost savings through efficient asset tracking.

Assign assets to team members as needed.

Release assets when tasks are completed.

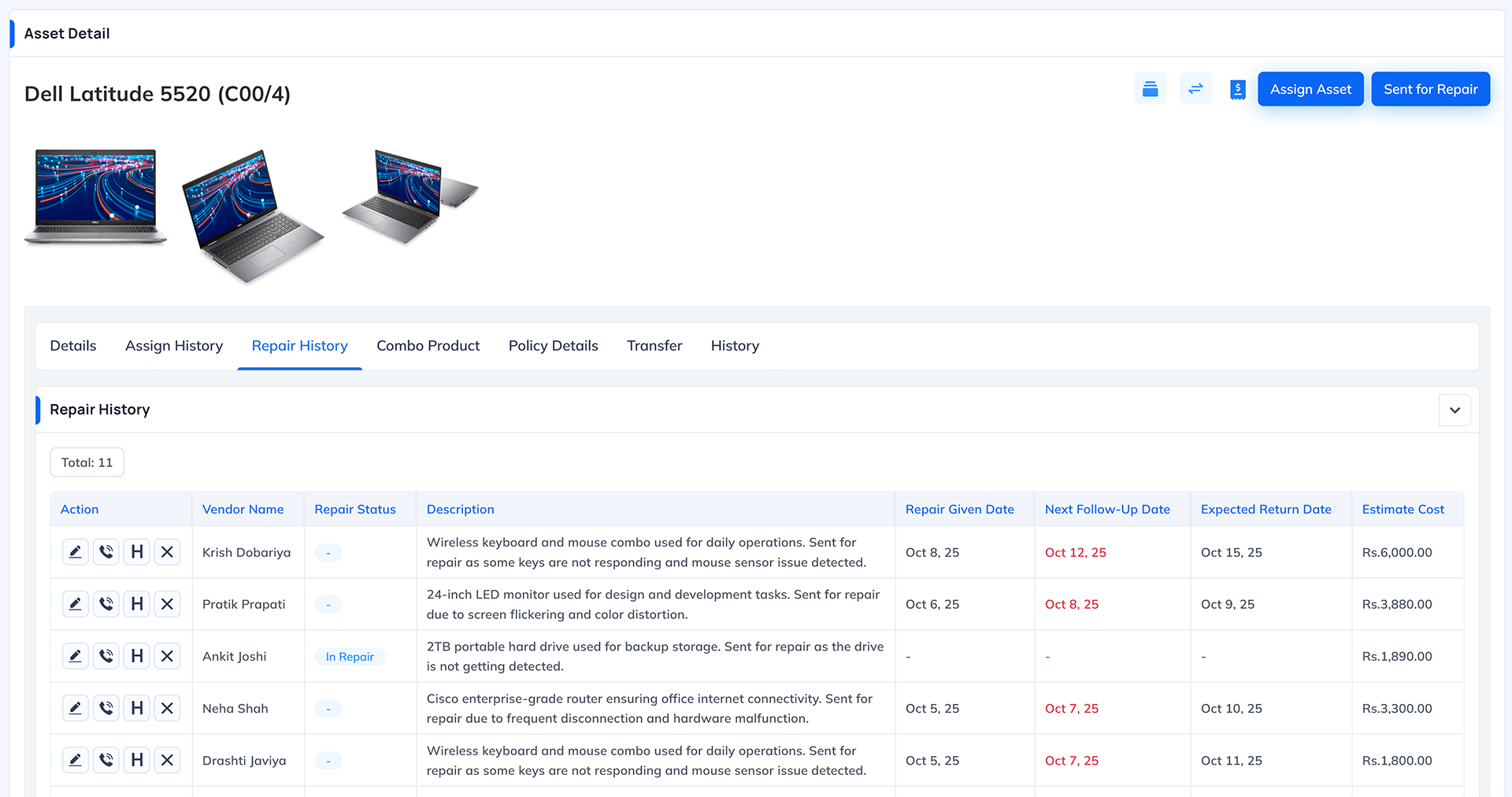

Track asset repairs with cost history.

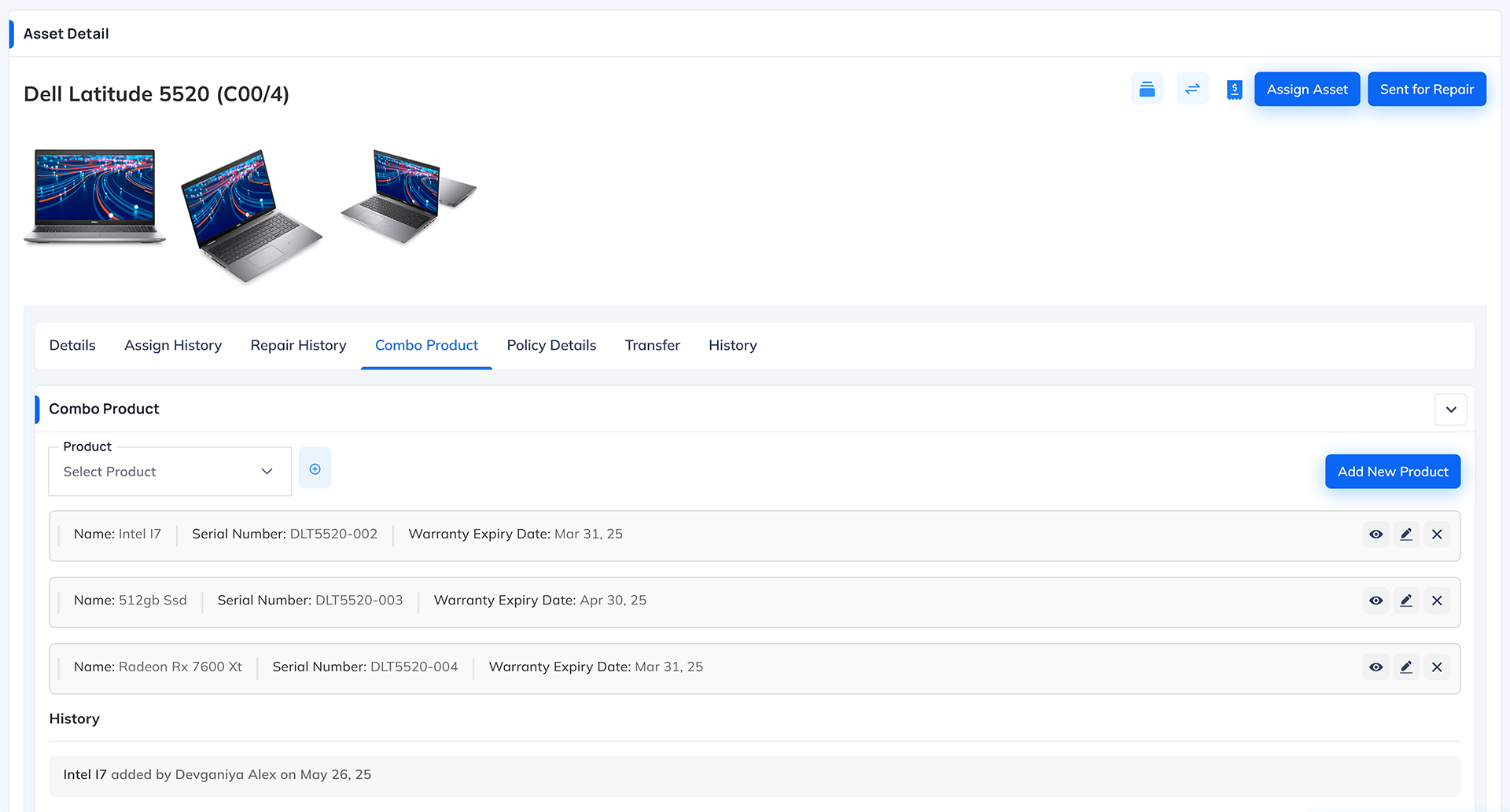

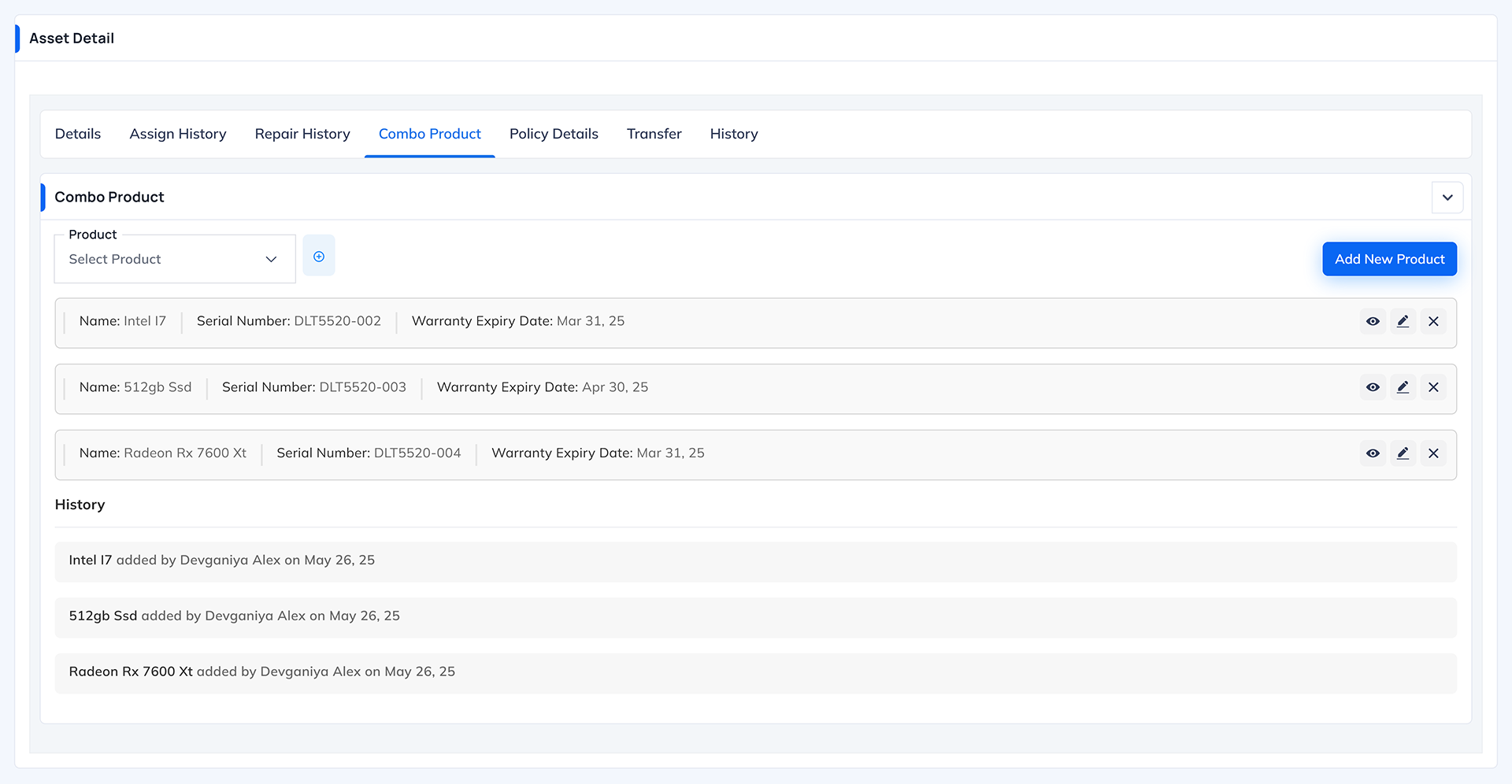

Manage combo products (e.g., CPU with components).

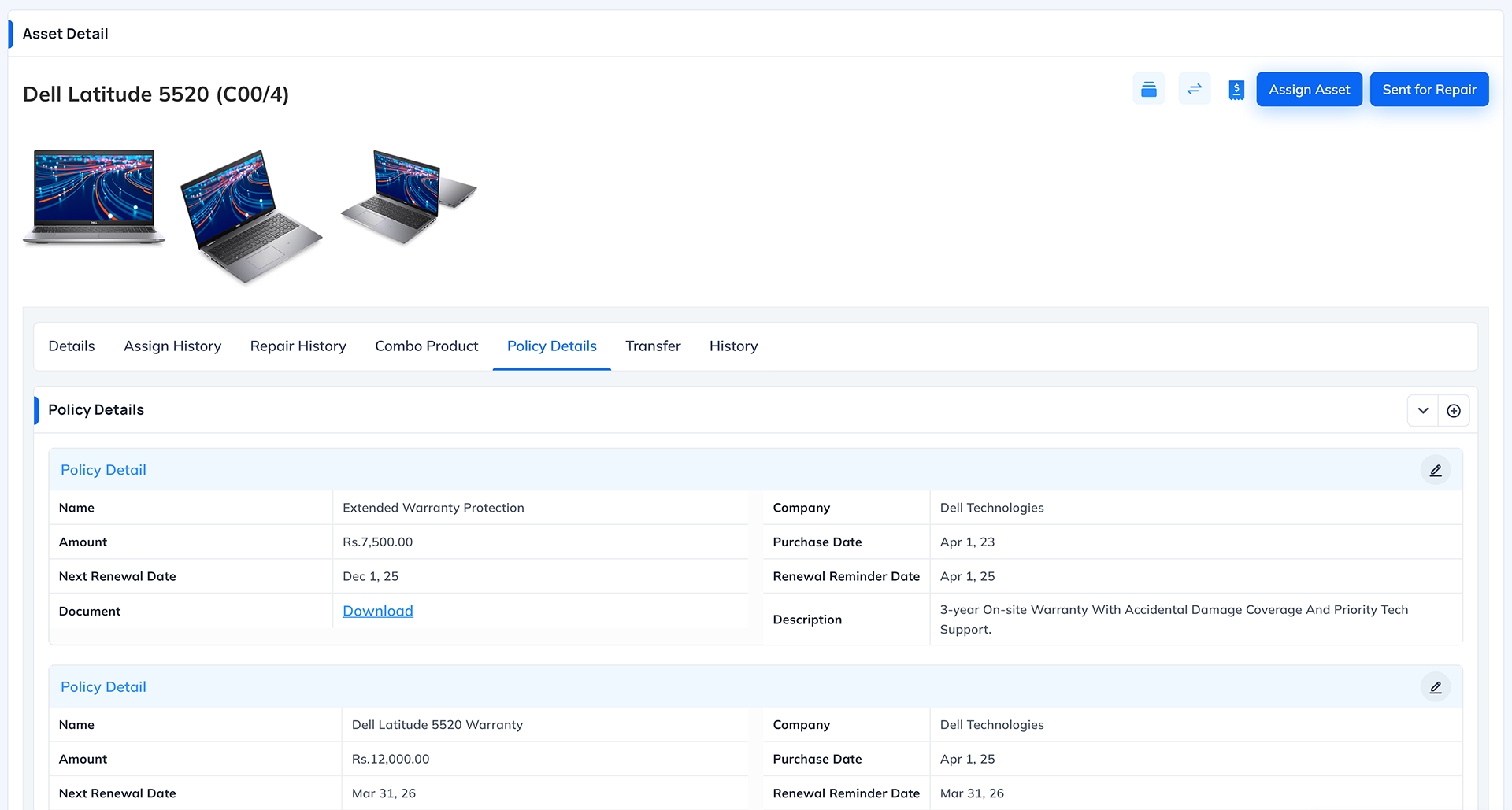

Monitor insurance with expiry alerts.

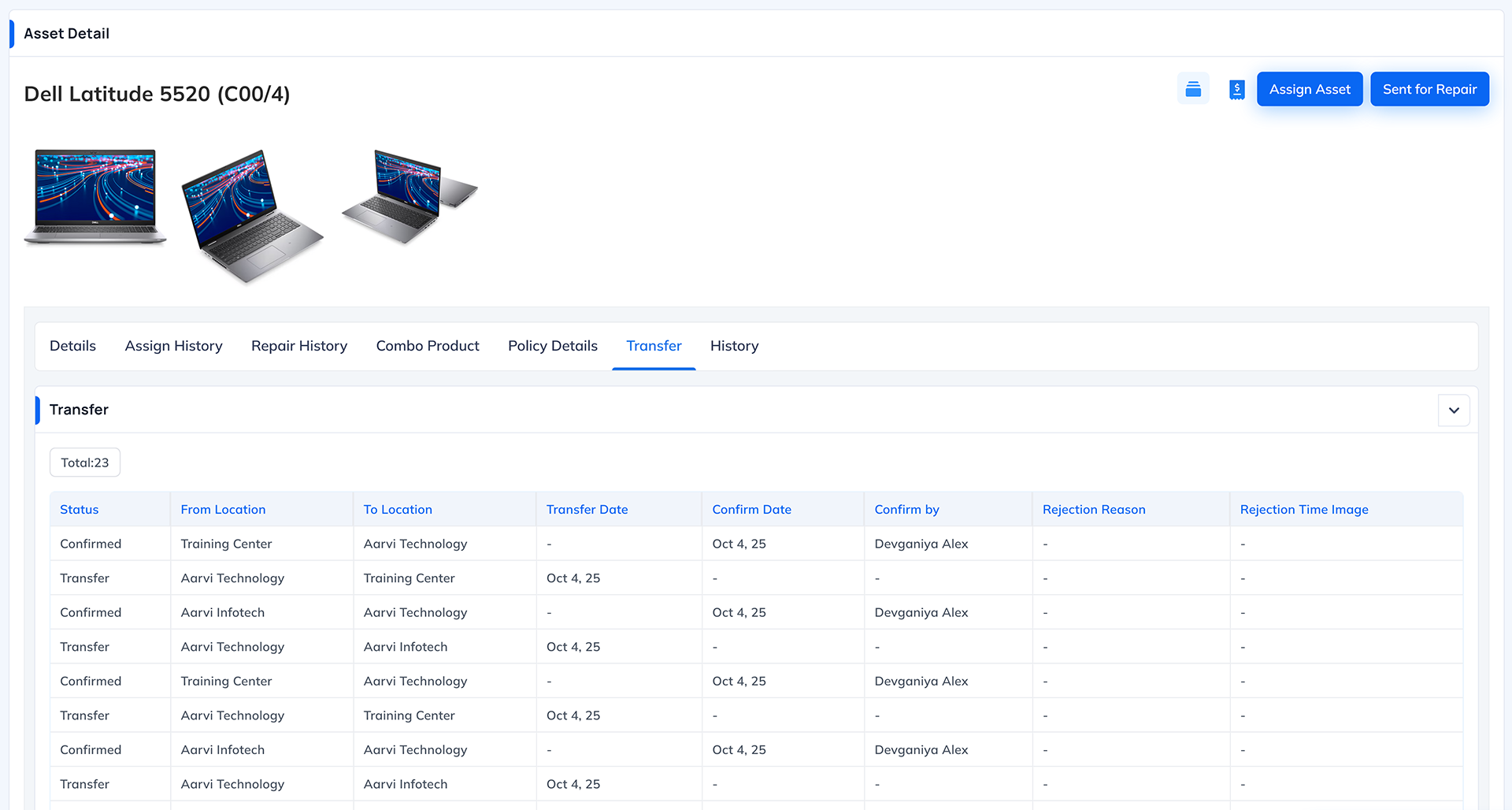

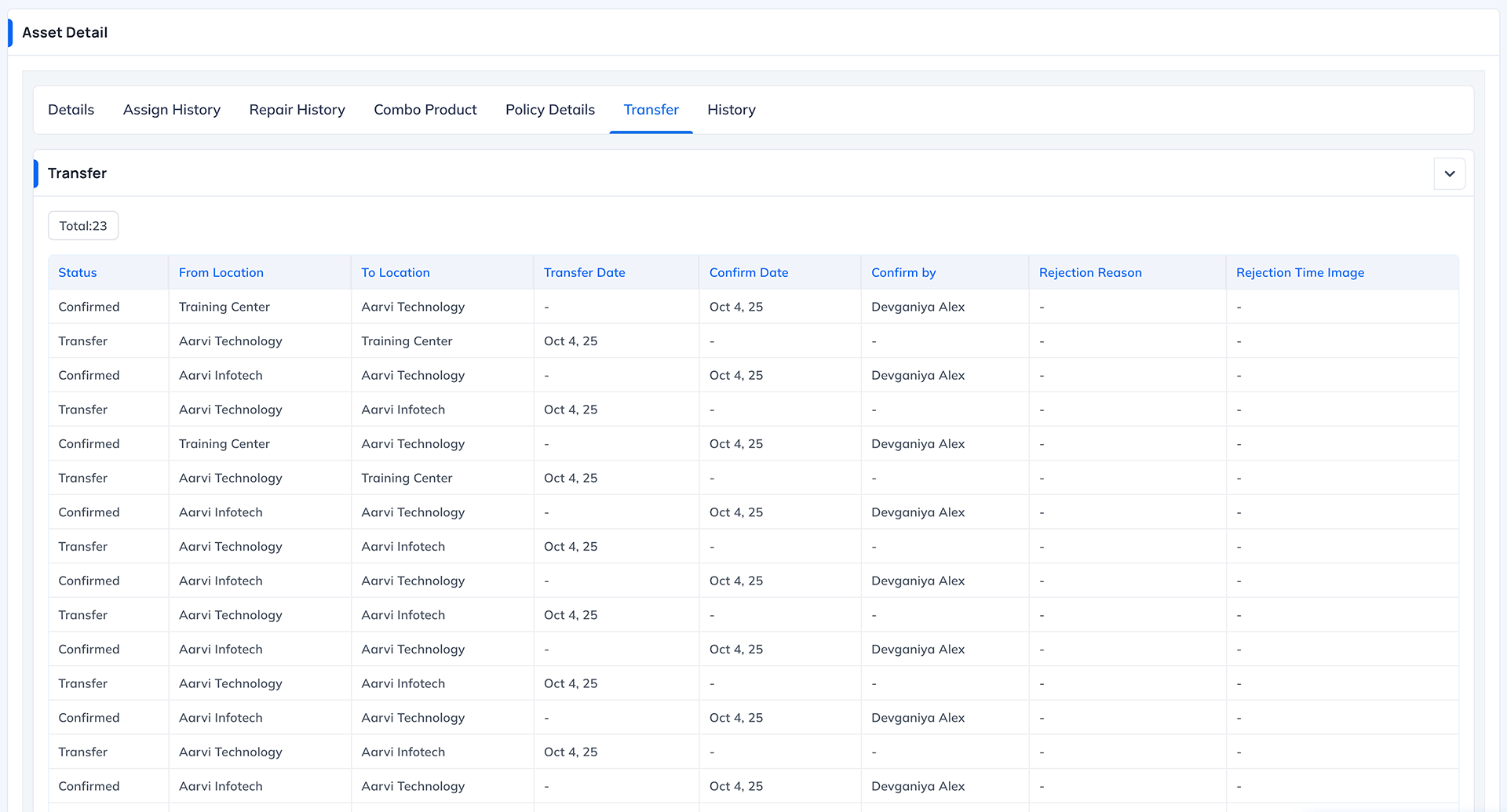

Manage asset transfers across locations.

Monitor asset purchases and associated expenses efficiently.

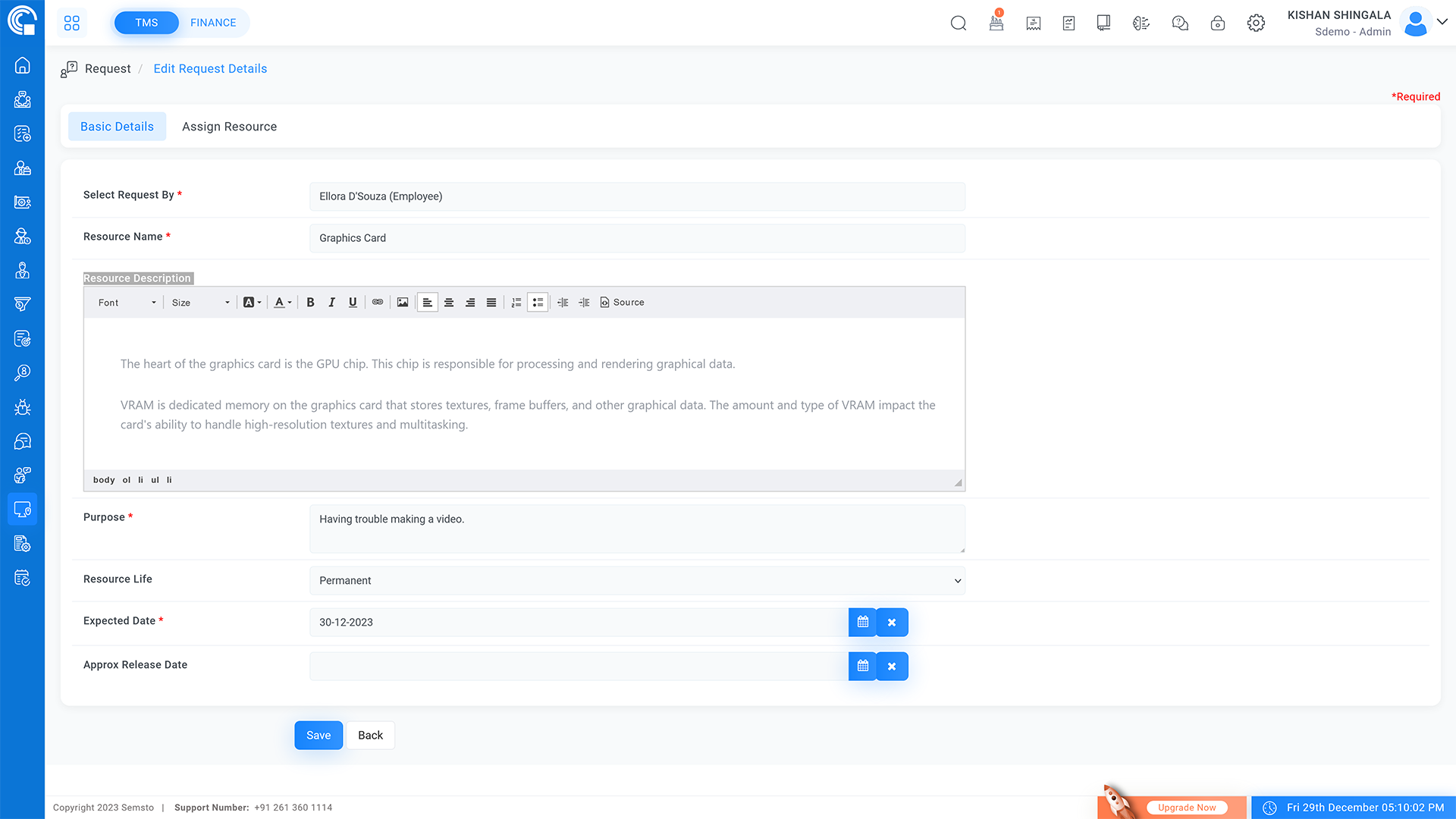

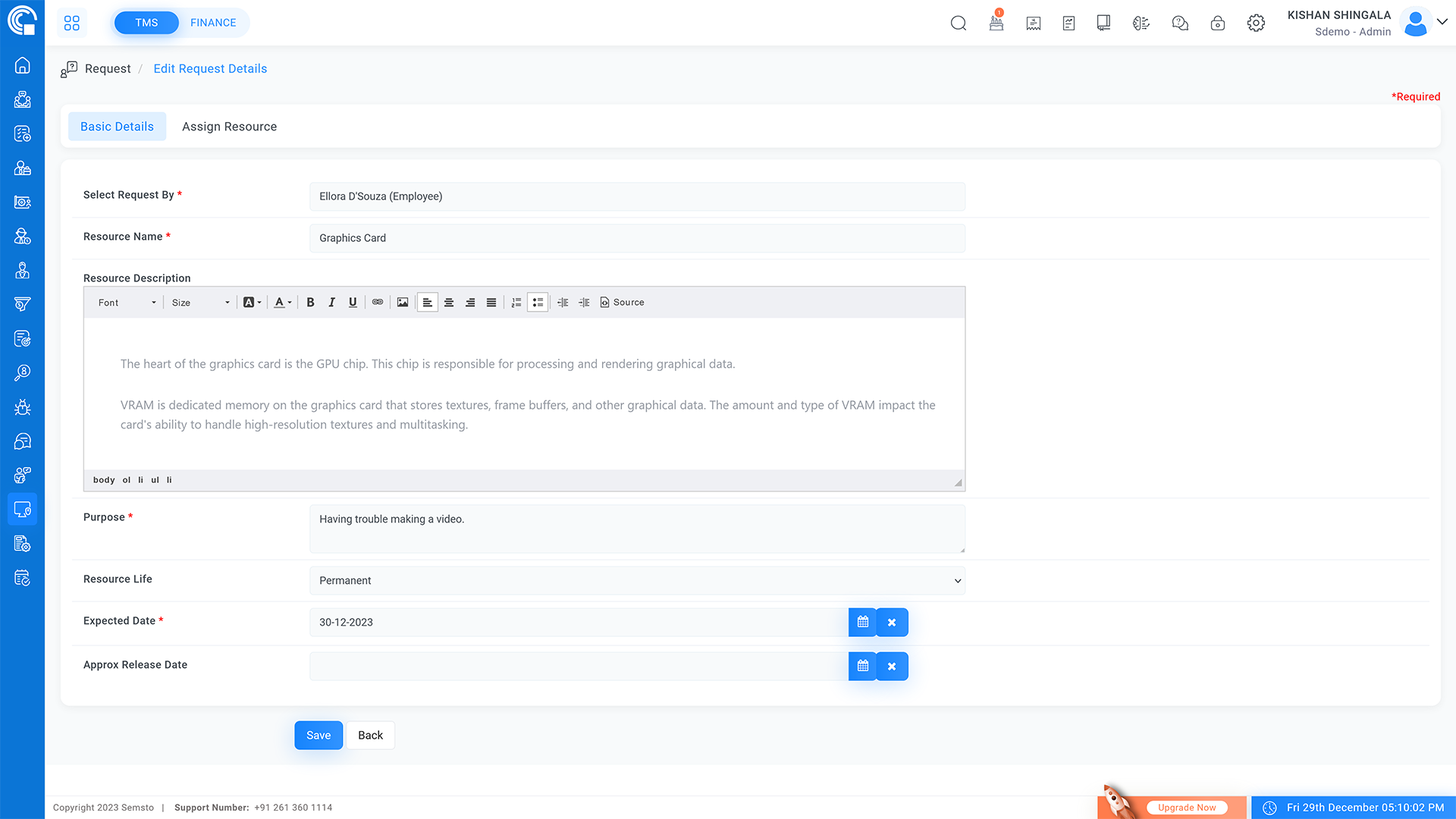

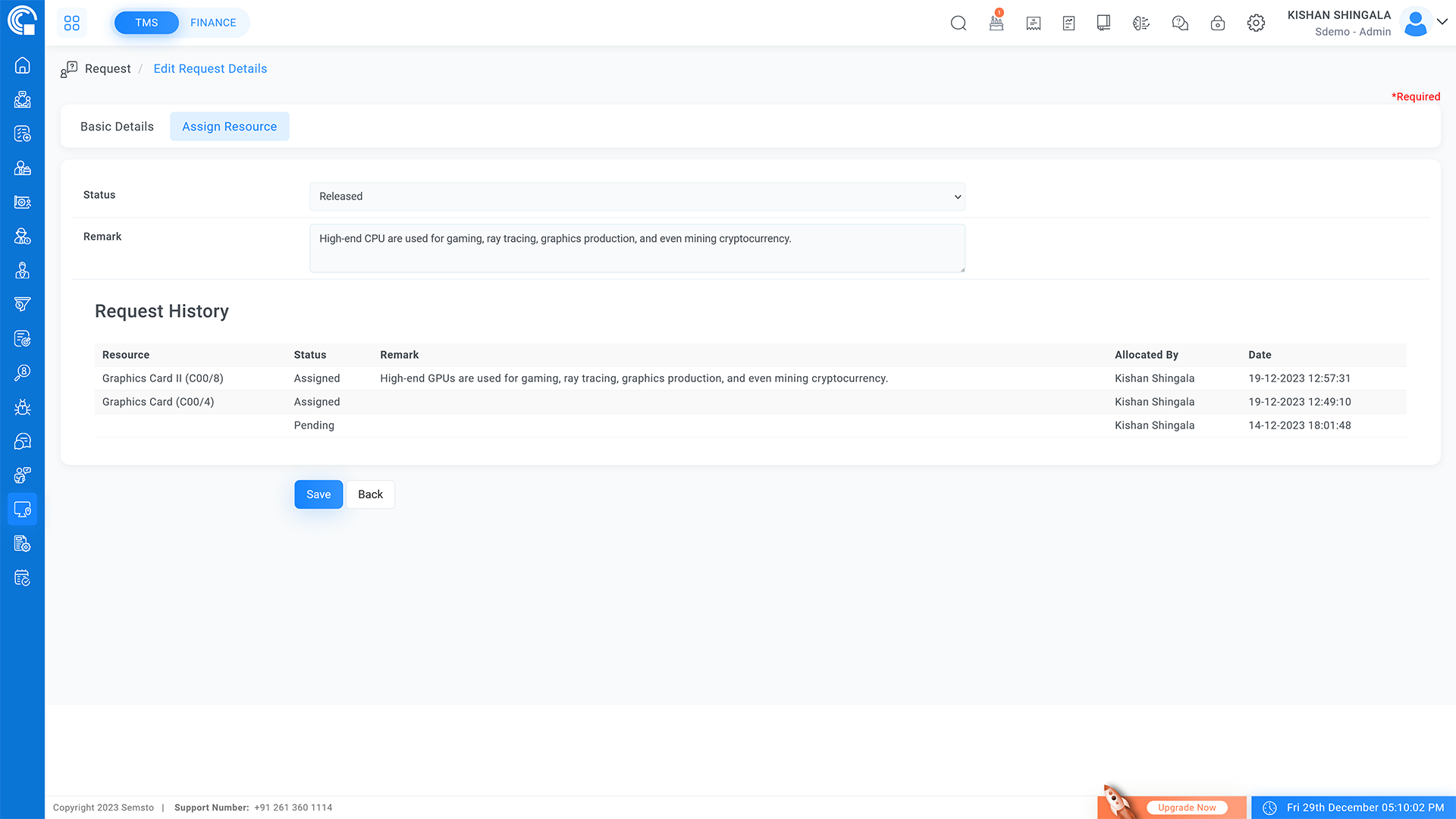

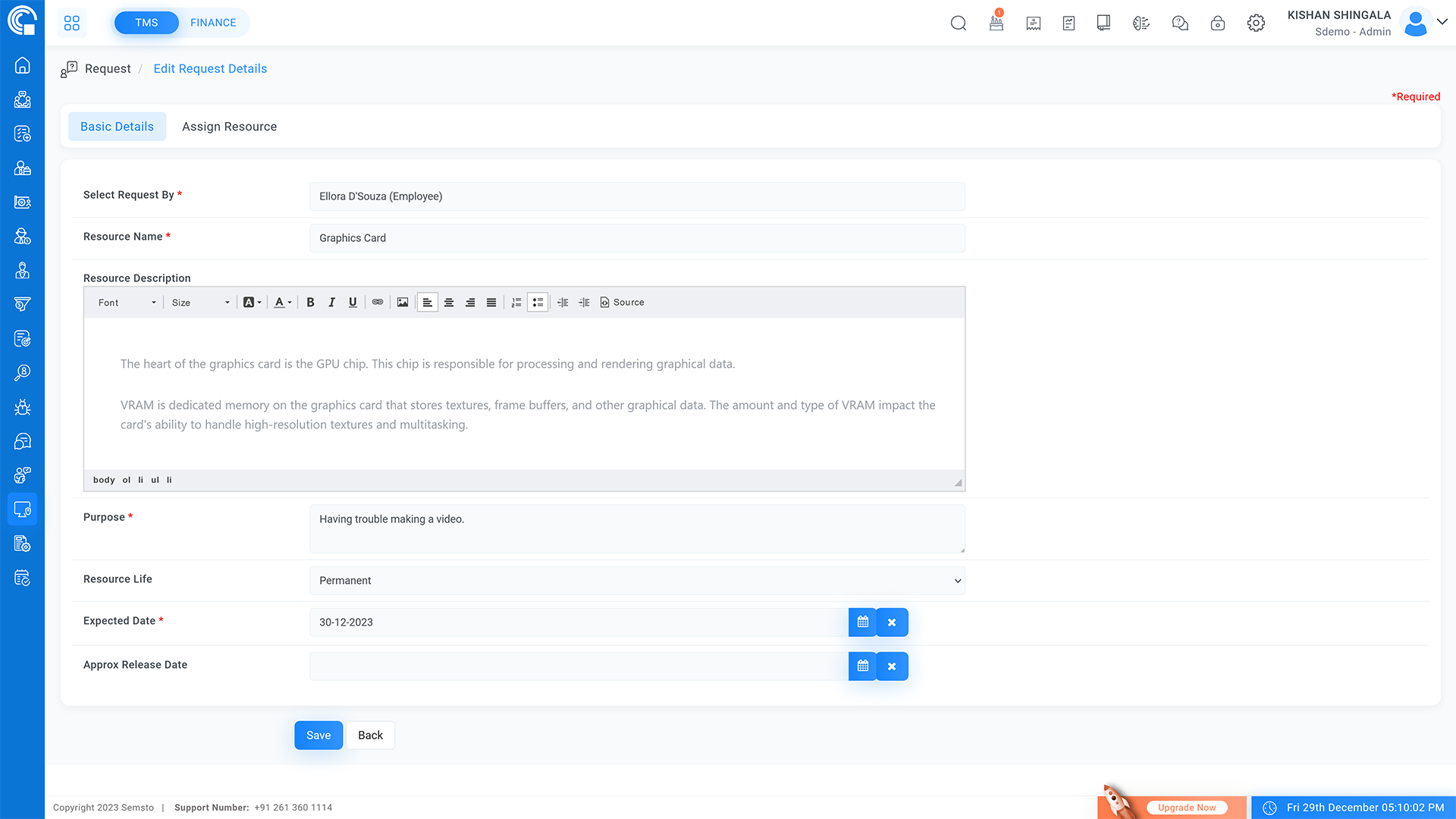

Enable employees to request assets with specified purpose and duration.

Predict resource needs and release assets when no longer required.

Avoid unnecessary asset acquisitions through effective management.

Track repair history and expenses to control maintenance costs and plan budgets effectively.

Manage combo products (like CPU sets) as unified assets while keeping visibility of their components.

Get reminders before insurance expiry to ensure assets remain covered without lapses.

Manage and monitor asset transfers across multiple branches or locations with full traceability.

Capabilities

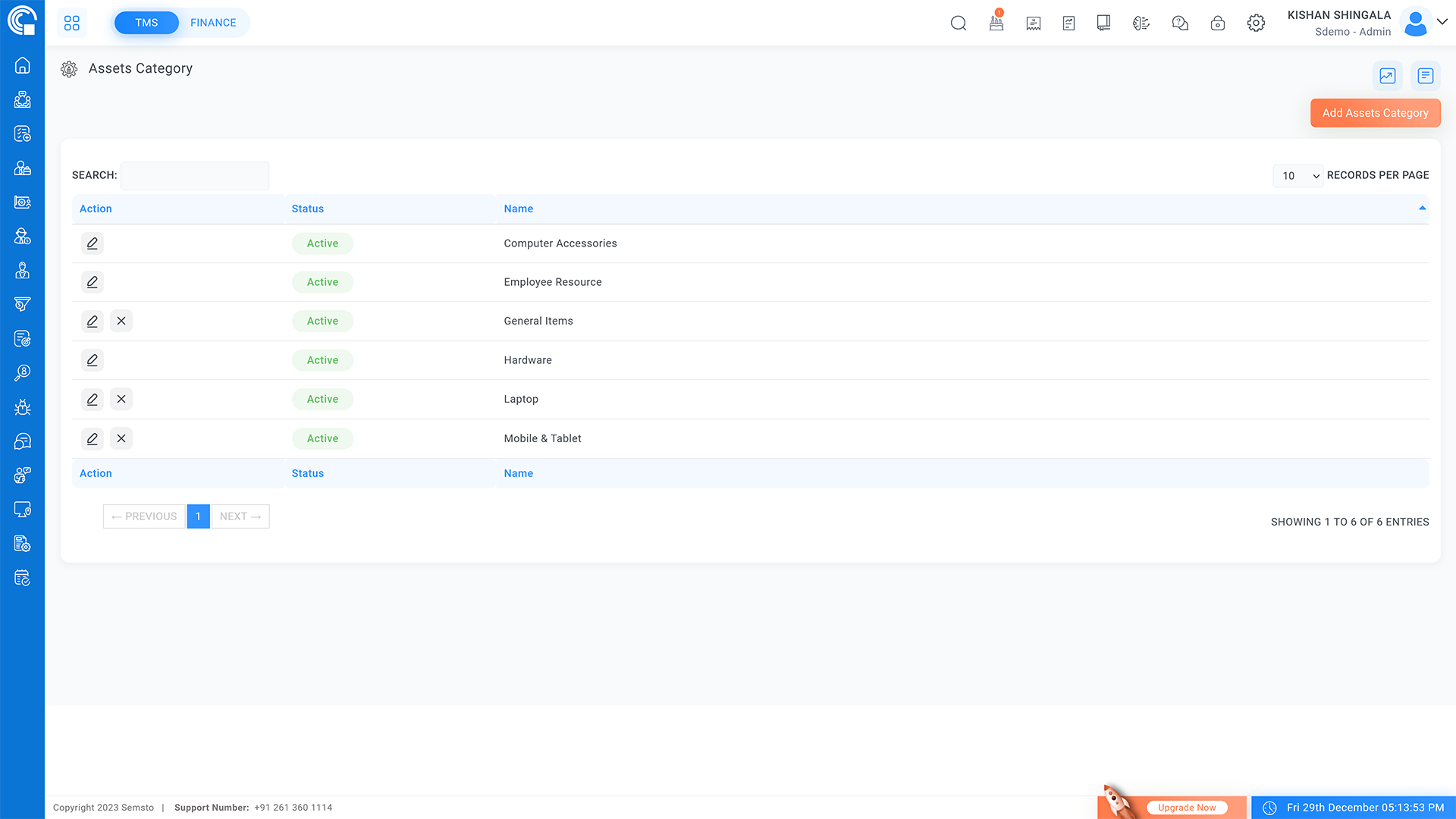

Assets Categories

Identify various assets, including mobile phones, computers and accessories.

Categorize assets based on type and usage for organized management.

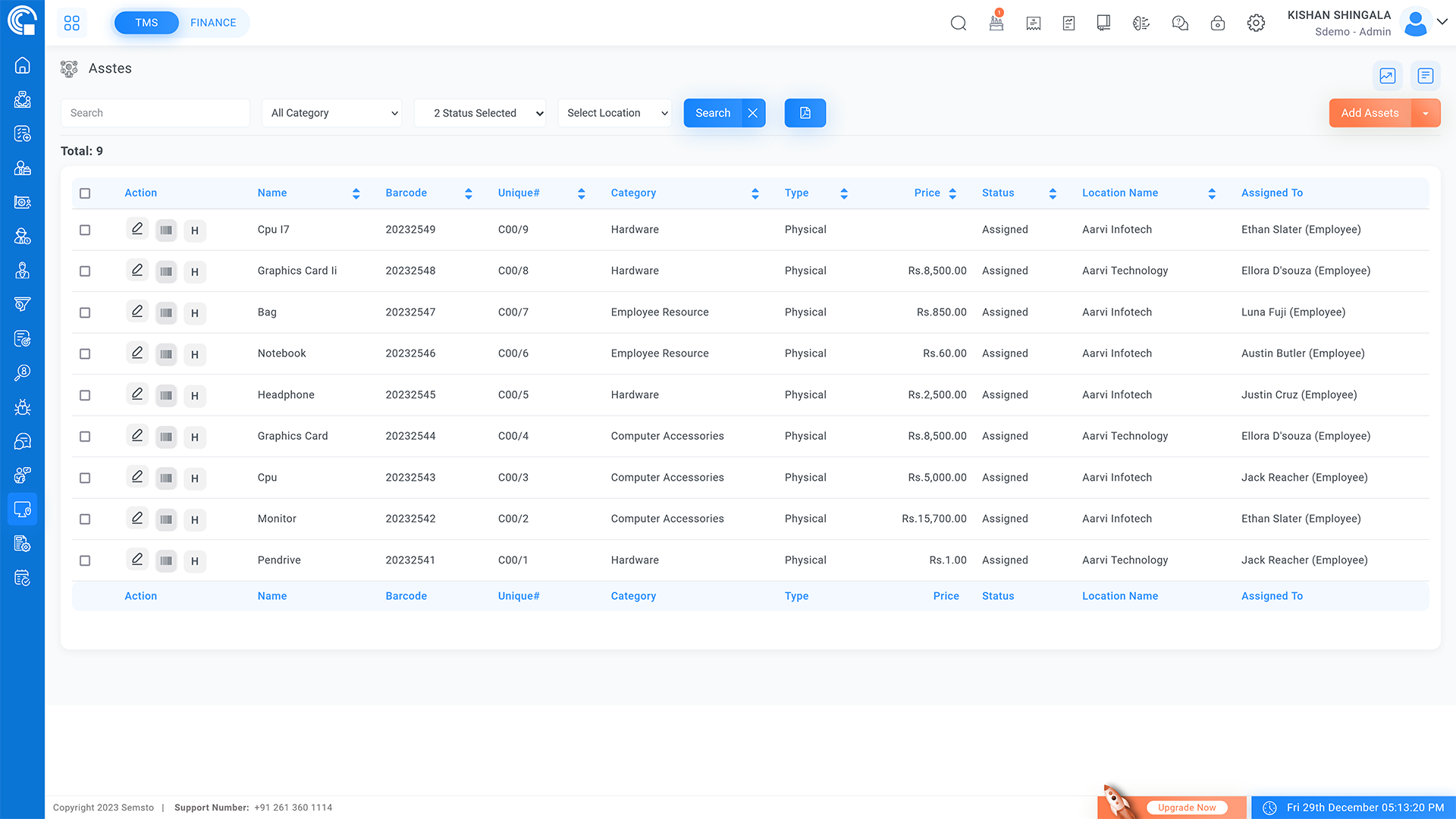

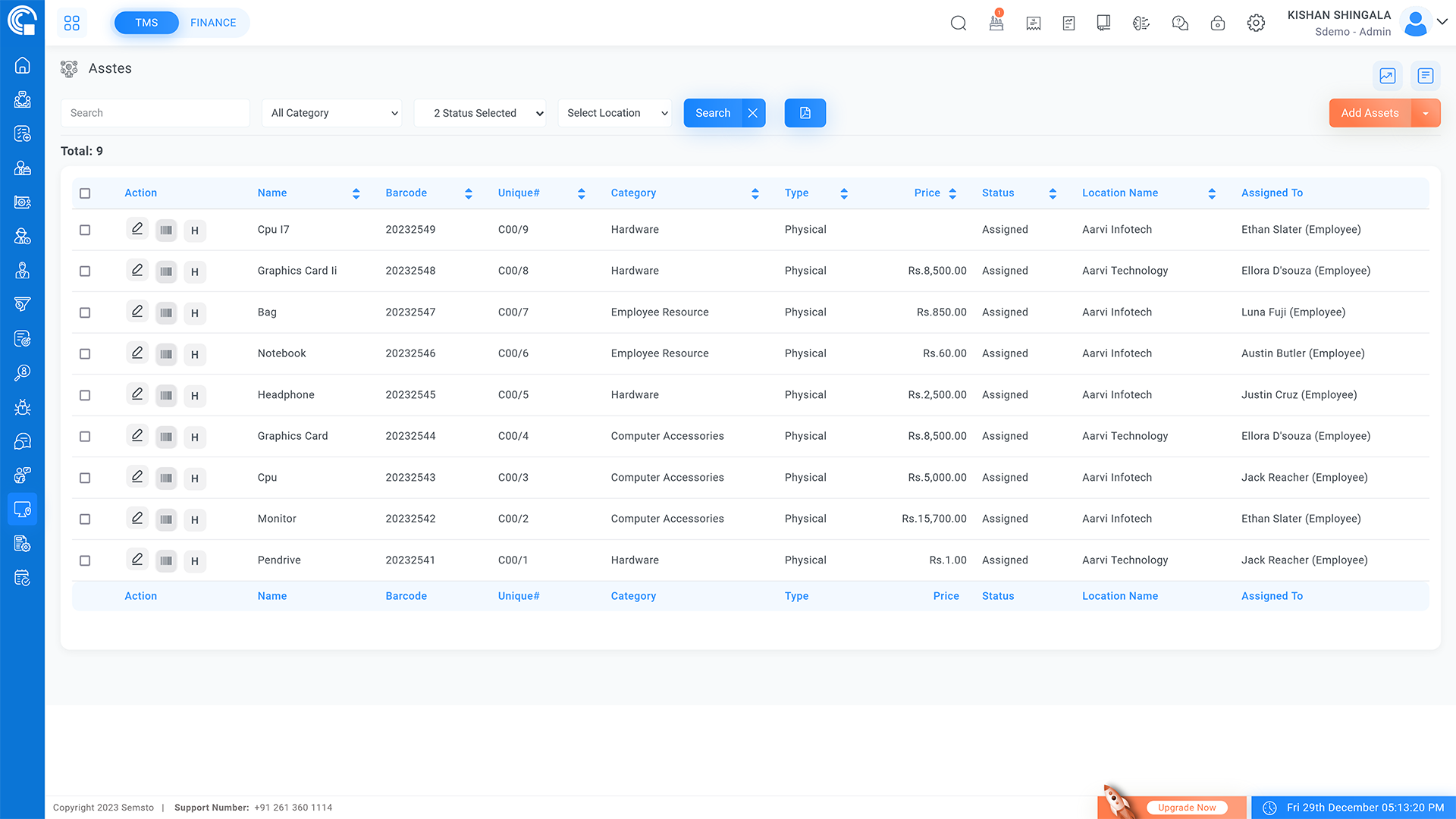

Manage Assets

Record all assets in the inventory.

Save purchase invoices for reference.

Create barcodes for each asset for efficient tracking and management.

Maintain comprehensive asset records, including serial numbers, purchase prices and warranty expiration dates.

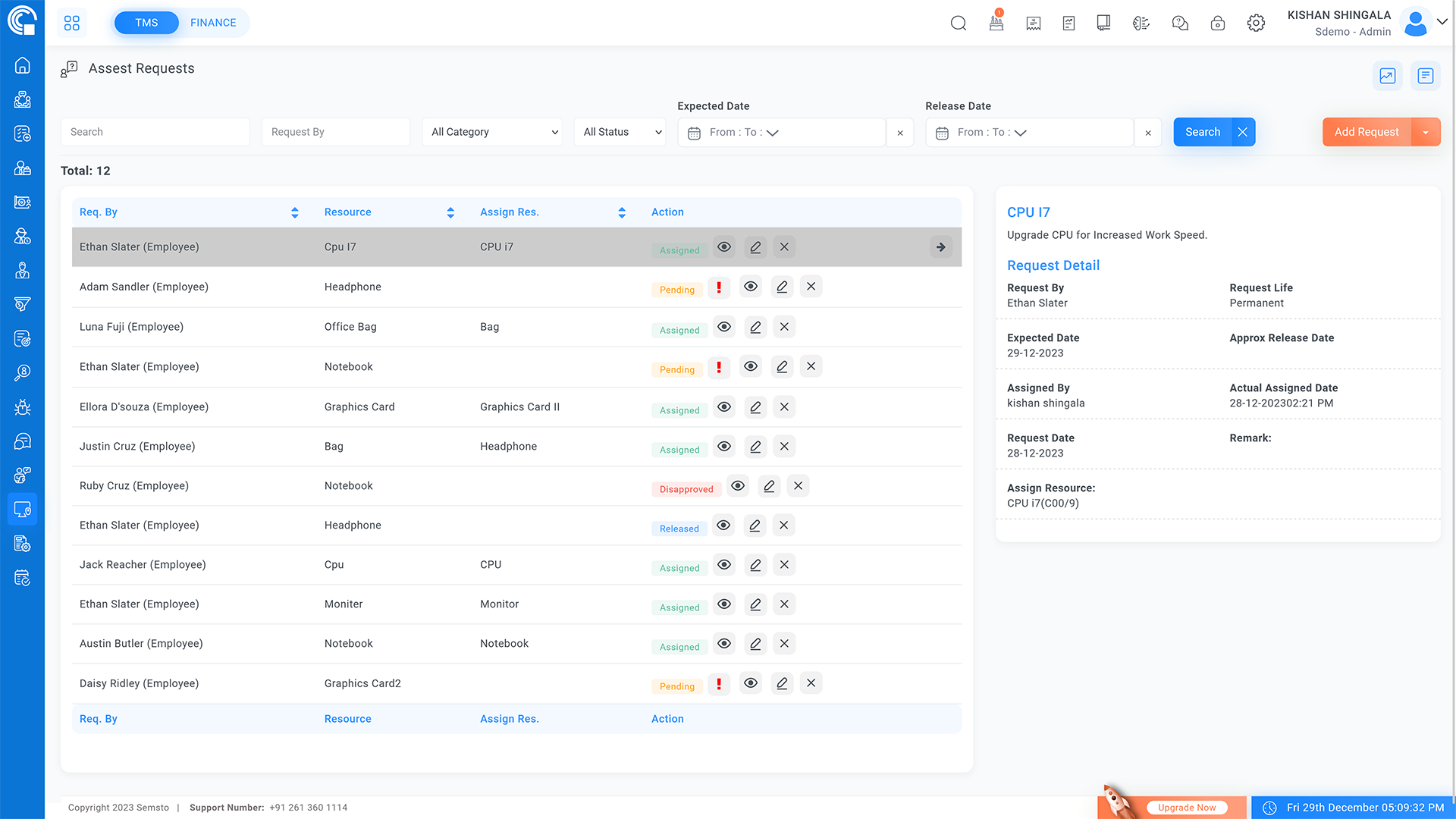

Asset Request

Manage and process asset requests from employees.

Assign assets to requesting employees.

Release assets that have been allocated and are no longer needed.

Repair & Maintenance Tracking

Record all asset repairs with dates, service details and costs.

Analyze recurring issues and plan for replacements.

Combo Product Management

Define and manage combo products composed of multiple items (e.g., CPU = processor + RAM + storage).

Track both the combo asset and its individual components.

Insurance Tracking

Store insurance details for each asset, including policy number, provider and validity.

Get alerts before insurance expiry to avoid coverage gaps.

Asset Transfer Management

Record asset transfers between departments, offices, or branches.

Maintain complete history of asset movement for accountability.

Pain Points

Maintain Comprehensive Records of All Inventory Stock

Absence of a System for Accessing Asset Warranty and Purchase Information

Inefficient Manual Procedure for Asset Requests and Tracking

Uncertainty About the Lifecycle of Assets

Repair costs often go untracked, leading to hidden expenses.

Insurance expiries get missed, leaving assets without coverage.

Asset transfers between locations lack visibility and accountability.

Why Asset Management?

Every organization invests heavily in assets — from laptops and machines to vehicles and tools. But without the right system, these valuable resources often become underutilized, misplaced, or even forgotten. Asset Management isn't just about record-keeping; it's about protecting your investments, saving costs and empowering teams with the tools they need to work efficiently.

With a smart Asset Management solution, companies gain:

Improved visibility and control: A centralized system to track every asset, from purchase to transfer, ensures nothing gets lost in the shuffle.

Smarter repair tracking: Log all repairs and costs so you can see where money is going, spot recurring issues and decide when to repair or replace.

Insurance peace of mind: Never worry about missing an insurance renewal again with timely expiry alerts, protecting your assets and avoiding financial surprises.

Efficiency through automation: Reduce manual errors by automating asset tracking, repair logging and insurance reminders.

Seamless transfers and accountability: Move assets between branches or locations while keeping full traceability of who had it, where and when.

Simplified management of complex assets: Manage combo products (like CPUs with multiple components) as a single unit while still keeping visibility of individual parts.

Reduced costs and wastage: Optimize asset utilization, reclaim idle assets and prevent duplicate purchases.

Data you can trust: Accurate, real-time asset data helps leaders make confident decisions on procurement, maintenance and budgeting.

In short, Asset Management brings clarity, confidence and control to one of your biggest investments — your company's assets.

Impact of Not Using an Asset Management Solution

On the other hand, relying on manual spreadsheets or scattered records can create daily frustration and hidden losses:

Assets go missing: Without clear visibility, equipment can be lost, misplaced, or "stuck" in one location.

Rising repair bills: Without repair history, the same assets keep draining money with recurring fixes.

Missed insurance renewals: One forgotten renewal can leave your company exposed to unnecessary risks.

Slow and inefficient processes: Manual tracking wastes employee time and creates bottlenecks.

Unexpected costs: Poor tracking often leads to duplicate purchases and misuse of resources.

Inaccurate data: Outdated or inconsistent records reduce confidence and create poor decision-making.

No accountability: Without transfer tracking, it's nearly impossible to know where assets are or who's responsible.

The result? Higher costs, lower efficiency and unnecessary risks that directly affect your employees and your bottom line.

With modern Asset Management, you don't just "track things" — you empower your people, protect your investments and create a workplace where resources are used smartly and responsibly.